Fat Tailed Thoughts: How ETFs Work

Hey friends -

This week we’re looking at the $6.5 trillion industry that is exchange-traded funds, more commonly known as ETFs. Not bad considering they didn't exist before 1993.

Many of you are probably invested in ETFs, especially those passive ones that try to mimic the performance of an index like the S&P 500. The same basic structure can be used for an active ETF like Cathy Wood's much-hyped ARK Innovation ETF or the Bitcoin Futures ETF that just launched.

While exchange-traded funds are prolific today - there are around 2500 in the US - few of us ever unpack how they work or why they even exist. Dig a little deeper and you'll discover that many of the funds we call ETFs aren't ETFs at all - they're other financial products riding the ETF hype-train.

In this week's letter:

Exchange-traded funds: what they are, their history, how they work, and how the service providers make money

Millennials want to direct their own investments, Democrats are four times as likely to be vaccinated as Republicans, and other cocktail talk

Taming the untamable with the Kingston Negroni cocktail

Total read time: 13 minutes, 31 seconds.

ETF Takeaways

At a good friend’s suggestion, I’m trying something new this week. I bolded key sections throughout the letter for emphasis which should help you get the gist of the story if you just have time to skim.

Let me know what you think!

WTF is an ETF?

Definition #1 - mistyped WTF. Anyone who regularly texts "WTF" and "ETF" will discover that the E and W keys are directly next to one another on the keyboard and that will inevitably lead to a follow-up text blaming autocorrect for the mixup.

More helpfully, we can look to State Street's definition:

An exchange traded fund (ETF) is a basket of securities—such as stocks, bonds, currencies or commodities—that can be bought and sold in a single trade on an exchange.

There is a lot packed into that definition. The important place to start is that it's wrong. Many of the other definitions you'll find online from major financial services providers are also wrong. ETFs are Investment Companies which, by their very definition, engage "primarily... in the business of investing, reinvesting, or trading in securities" (source). Currencies and commodities are not securities.

The second key element to highlight is the "basket." When we talk about exchange-traded funds, the emphasis is on the fund. You as the investor own shares in the fund. The fund in turn owns the underlying securities. Your shares represent proportional ownership in those underlying securities.

Up to this point, ETFs look a lot like mutual funds. The major differentiator is that ETF shares are "listed on a national securities exchange and trade at market-determined prices" (source). That turns out to make a world of difference.

With a mutual fund, you buy shares directly from and sell shares directly to the mutual fund itself. At the end of every day, the mutual fund calculates the net asset value of the fund, the industry term for how much the assets the fund owns are worth. It uses that value to determine how many shares to issue you if you're buying or how much money to return to you if you're selling.

With an ETF, you're not engaging the fund directly. Rather, you are purchasing shares in the ETF that are being sold by someone else! It's a secondary market, not a primary market. These shares are listed on exchanges which facilitate the buy/sell order matching and routing, similar to how stocks are bought and sold. And just like stocks, you can trade throughout the day.

While this may seem like a small change, it was in fact controversial for its time and took multiple years to develop. From the LA Times just before the launch of the first ETF:

Other Wall Streeters argue that while SuperTrust does afford some new flexibility in trading and investing in the stock market, there isn’t enough of a difference from existing products to lure buyers... Gus Sauter, manager of the Vanguard Index Trust 500 mutual fund, doubts that most small investors would care much about intra-day trading.

To see why it was controversial, we have to take a brief look at the history of ETFs.

From Mutual Funds to ETFs

The predecessor to the ETF is the mutual fund, the very first of which launched in 1924 and, remarkably, is still around today! And it's not just the mutual fund that's still around, the custodian at launch was State Street and remains so today.

Mutual funds took off in earnest from a combination of regulatory innovation and stock market gains. The Investment Company Act of 1940 set the stage with more stringent investor protections that made the mutual fund structure more appropriate for mom and pop investors and, as a result, expanded the applicable market. A lack of subsequent regulatory development paved the way for brokers to generate significant commissions selling mutual funds. You can probably guess how this turned out.

As stock market gains through the '50s and early '60s led to the popularization of investing, a period chronicled in John Brooks's The Go-Go Years, the mutual fund was positioned by brokers as a way for the everyday man access to "experts" who could pick stocks on their behalf. With the stock market on the rise, many mutual fund managers looked brilliant.

All good things have to come to an end and the stock market dutifully did so in 1969. While in nominal terms the market dropped by over a third, the real damage came when coupled with inflation. The S&P 500 was flat from 1966-1982 in real dollars. As the tide went out, investors discovered that many of their "star" fund managers were swimming naked. The broker-facilitated mutual funds turned out to be better sales than product - the fund managers got rich even as the funds crashed.

Slowly but surely, a new investing philosophy came into vogue. What if, instead of trying to find a brilliant fund manager who can beat the market, you could simply match the returns of the market overall? At low cost, and mostly passively, you should be able to produce a decent return.

Such was the strategy pioneered by Wells Fargo in 1973 and shortly thereafter popularized by John Bogle of Vanguard fame. These were mutual funds that tried to match the performance of indexes, like the S&P 500. These indices could give investors an ability to invest in "the whole market" rather than just individual companies.

Fast forward to the late '80s. Indexed mutual funds are continuing to rise in popularity but there's a belief that they can be made even better. What if you could lower fees almost to zero? What if you could allow the funds to trade throughout the day - not just at the end of the day - so they could be useful as part of larger investing strategies?

It was the latter utility as part of larger investment strategies that drove the first attempt at an ETF. In the 1980s, a firm by the name of Leland, O'Brien, Rubinstein Associates (LOR) pioneered the use of "portfolio insurance." The small, 18 person firm grew to manage over $5 billion directly and license portfolio insurance for another $45 billion (over $100 billion in 2021 dollars).

The insurance turned out to be illusory. When the stock market crashed in 1987, the insurance failed to do its job. This left the belle of the ball in a sticky situation - client assets declined to just $750 million and they needed a new product to hedge such events. They turned to an idea that had been proposed in the '70s by Professor Nils Hakansson that had previously been deemed too complex to implement. Embedded in the complexity was something we today would recognize as an ETF.

LOR and its partners spent multiple years and $5 million ($11.5 million in 2021 dollars) developing a simpler structure that might work. The idea was considered controversial and "simpler" turned out to be relative. While the company formally applied for permission to launch in 1989, the proposal resulted in 5 amended applications and a hearing before it was finally approved.

The final approved structure was named the SuperTrust. It consisted of no less than six separate securities, two of which traded on the American Stock Exchange and four of which traded on the Chicago Board of Options Exchange. Buried within this "simpler" structure were two ETFs as we know them today - one exchange-traded fund which tracked the S&P 500 Index and another that held money market funds.

The complexity didn't go over well with prospective investors and the low underwriting fees provided little incentive for brokers to sell the product. LOR targeted a $2 billion launch that had to be embarrassingly scaled back to just half when it finally went live in November 1992. But the damage to the product was already done. American Stock Exchange, one of LOR's partners, proposed an even more simplified version of the SuperTrust that just focused on the ETF.

The regulator approved the product for launch in 1992 and it went live in late January 1993, just three months after the SuperTrust. This was a bit of a homecoming - the very same State Street who helped launch the first mutual fund in 1924 was the driving force behind this first standalone ETF! Such a move turned out to confer a remarkable first-mover advantage. The ETF in question is the SPDR (pronounced "spider"), listed as ticker: SPY, and it remains the largest ETF in the industry with over $400 billion under management.

As for the more complicated SuperTrust? It was ended in 1995. The verdict was clear and the modern ETF industry was born.

ETF Regulations & Mechanics

We're going to focus strictly on ETFs. They're complicated enough as is without venturing into the broader arena of other Exchange Traded Products (ETPs) that are often mislabeled as ETFs.

ETFs are regulated by the Securities and Exchange Commission and registered under the Investment Company Act of 1940, colloquially known as the '40 Act. While the '40 Act generally regulates Investment Companies, it's important to note that Investment Company is a term of art. Many exemptions can result in funds and fund-like vehicle registering under other regulations such as the Securities Act of 1933. The other Exchange Traded Products fit in this bucket, including Exchange Traded Commodity Fund and Exchange Traded Notes.

ETFs can either be open-ended funds or unit investment trusts. The former sells shares continuously and includes mutual funds and many hedge funds. The latter makes a one-time sale of a fixed number of redeemable securities called units. These units are redeemable and actually dissolve on a date specified at launch, although the date can be extended with regulator approval. The SPDR is a good example - it would have dissolved in 2018 had the date not been amended to 2118.

For investors, there are two key differences between ETFs structured as open-ended funds and those structured as unit investment trusts. The former has greater flexibility in the asset mix - it can use derivatives, lend securities, and choose not to exactly follow an index and instead allow for manager discretion. Critically, it can also reinvest dividends. The latter must fully replicate the index and cannot reinvest dividends - they're held until they're returned to the investors quarterly or annually. While unit investment trusts can offer greater investor protection by limiting what the fund can do, it comes at the cost of potential upside offered by manager expertise and "dividend drag" - the lost gains due to dividends not being reinvested.

Where ETFs get truly interesting is the underlying mechanics. How do you create a basket of securities that investors can buy and sell on an exchange while still ensuring that the price of the basket accurately reflects the makeup of the underlying securities?

Two markets are better than one

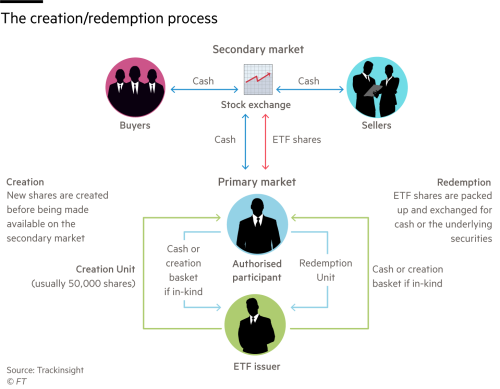

While you and I buy shares of the ETF on an exchange, hiding in the background is a separate primary market where Authorized Participants buy and sell shares of the ETF directly to and from the ETF issuer.

These Authorized Participants support the creation/redemption process. During creation, Authorized Participants exchange cash or an equivalent basket of securities that mirrors the index with the ETF issuer. In return, the ETF issuer issues new ETF shares that the Authorized Participant can sell in the secondary market. Redemption works in the reverse - Authorized Participants turn in ETF shares in return for cash or a mini basket of securities that mirrors the index.

What the Authorized Participants are doing is arbitrage. If the price at which the ETF trades in the secondary market is higher than the sum value of the underlying securities, then the Authorized Participant can make money by buying the securities, exchanging them for ETF shares, and selling those ETF shares. If the ETF price is lower than the sum value, then the Authorized Participant redeems the ETF shares and sells the underlying securities. The net effect is to keep the ETF secondary market price in line with the value of the underlying securities.

Authorized Participants is a highly concentrated market mostly made up of big banks. Each ETF is required to regularly file a Form N-CEN that includes details on the Authorized Participant list and the amounts they created and redeemed in the prior period. For instance, in the most recent SPDR filing, we find 43 Authorized Participants including the most active - Goldman Sachs - who created $158 billion in shares and redeemed $228 billion. Many of the Authorized Participants had no activity at all.

While creation and redemption is the core mechanism, the full ecosystem is more complex.

Small fees x Large volumes = Lots of money

There are many, many companies involved here each of whom has to get paid. That makes it all the more remarkable that average funds fees are 0.18%, much lower than almost any other financial product in the market. What makes ETFs attractive to financial services providers is the volume both in absolute terms and in daily active trading. Few to no other products are a $6.5 trillion industry. The fund fees alone generate $12.27 billion in revenue and more is made by the market-makers, brokers, and stock exchanges who facilitate secondary trading.

Investors owning the ETFs eventually pick up the tab for the fees, but they flow through multiple parties first. All of those parties you see directly surrounding the ETF issuer - the data vendors, index provider, legal, etc. - all charge fees to the issuer. So too does the Fund Administrator at the bottom and the various firms that support administration including custody and accounting. Some of the fees are fixed whereas others, typically including custody, are variable based on the value of the assets. All of these fees, as well as the fee paid to advisors for actually managing the index, get paid via the fund fees that are passed on to the investor.

The trading fees from brokers and exchanges are also passed on to the investor. They may be charged directly as a flat or variable fee per trade, or in less obvious ways as the broker takes home the spread, the difference between the buy (bid) and sell (ask) prices.

The exception to the investor picking up the tab are the fees borne by the Authorized Participant, notably including the market maker fees. While on paper the Authorized Participants pay these fees, they only pay them out of revenue generated by the creation/redemption process. If that's not lucrative, they'll exit the business unless the ETF issuer can find a way to make it more lucrative for them. That can result in higher fund fees paid for by the investor.

Even with everyone getting paid, costs generally stay low precisely because of the ETF structure. Like with indexed mutual funds, portfolio management can largely be automated based on the index which minimizes cost. ETFs have two additional advantages which keep fees less than half those of equity mutual funds. By only having a small number of Authorized Participants with whom the ETF issuer has to trade, the fund minimizes those trading costs. Those costs are instead borne in part by the Authorized Participant for creation/redemption and in part by the broker for facilitating retail investor purchases and sales. Each of these parties can specialize in just one piece of the puzzle which drives lower costs across the entire ecosystem.

The two-market, multi-party setup also confers another major advantage to ETFs - much lower taxes.

Tax optimized trades

Just like for you and me, if a fund sells a security that appreciated in value, they accrue a capital gain. By law, the fund then has to pay out the capital gain to investors at the end of the year. Unless the investor is holding the investment in a tax-free account like a 401k, they will owe the resulting capital gains tax. That reduces the investor’s returns.

ETFs mostly avoid capital gains. Let’s start with mutual funds to understand why. When an investor sells their shares back to the mutual fund in exchange for cash, the mutual fund often must sell securities to raise cash. The sale can result in a capital gain. But when an ETF investor wants to sell their shares, they sell them in the secondary market to other buyers - the fund isn’t involved. That means no capital gains for the fund!

But what about when Authorized Participants redeem ETF shares? Well, if the issuer pays the Authorized Participant in kind, that is to say pay them with the underlying securities rather than with cash, there’s no sale of securities and no capital gain.

That’s pretty cool. Not only does the two-market ETF setup help optimize costs through specialization, it also (near) eliminates capital gains!

ETFs Part Deux

Next week we'll analyze the ETF market makeup today. The rise of passive investing coupled with the dominance of major indices by a few massive companies has led to new, unique risks for the market. Risk may be showing up in other corners of the ETF industry as well, places where regulators are just beginning to shed light.

We'll also look at what can happen when ETFs expand beyond stocks. The ETFs limitation to investing in securities turns out to be quite a broad mandate and includes funds as varied as commodity ETFs, currency ETFs, and most recently a Bitcoin ETF. These aren't always as straightforward as they appear and things can go awry as an ETF inherits complications from its underlying assets. We'll use the Bitcoin ETF as an example to explore and see why not all ETFs are made equal.

Cocktail Talk

Two great articles this week on The Great Wealth Transfer. For the millennials with money to invest: 70% of families with a net worth greater than $500,000 and headed by an individual over the age of 45 had a self-directed investing style, up from 57% in 2010. For the have-nots: millennials born in the '80s have a 50/50 chance of earning more than their parents compared to a 90% chance for those born in the '40s. (WSJ, Economist)

Covid continues to dramatically play out along partisan lines. Counties that voted 60%+ Trump in 2020 experienced three times the mortality rate of the 60%+ Biden counties this past October. The divide has persisted at least since the start of 2021 and is similarly reflected in average daily new case rates. The cause is likely highly linked to vaccination rates: 40% of Republican adults are unvaccinated versus 10% of Democratic adults. (NY Times)

How many times a day do you look up the weather on your phone? Or use a maps app for directions? There's a good chance that the company providing you that hyper-local information for "free" is selling your precise location data. The IRS is now a buyer of that data, allowing them to deduce hyperlocal information and effectively track citizens without a warrant. (The Intercept)

The percent of American adults who own cryptocurrency more than doubled between 2019 and 2020 to 4%. The finding is part of a broader research study that also discovered that while crypto ownership was roughly the same for men and women through 2017, the percentage of men who own crypto spiked dramatically in 2018 and remains comparatively elevated. (Coindesk, BIS Working Paper)

Your Weekly Cocktail

The classic Negroni perfectly accompanies pizza. This variation steps it up.

Kingston Negroni

1.0oz Smith & Cross Traditional Jamaican Rum

1.0oz Carpano Antica Formula Sweet Vermouth

1.0oz Campari

Lemon peel for garnish

Pour all of the ingredients (except for the lemon peel) into a mixing glass. Add ice until it comes up over the top of the liquid. Stir for 20 seconds (~50 stirs) until the outside of the glass is frosted. Strain into a rocks glass (optional: serve over ice). Squeeze the lemon peel over the drink to express the oils and drop it in.

Campari is a beast of spirit. Distinctive both for its bright red color and its wildly bitter taste, it is among the most divisive of the well-known amari. The traditional Negroni (equal parts gin, sweet vermouth, and Campari) is one of the few popular cocktails that can tame it, and even then many bars will pare back the Campari to better "balance" the drink. The Kingston Negroni does the opposite. It brings two heavy hitters to the glass that more than hold their own with the amaro - a navy strength, pot still Jamaican rum with deep caramel notes and a standout sweet vermouth atypically spiced with vanilla and other strong flavors. The result is polarizing and I love it. If it's all a bit much, try the drink over ice and let the dilution mellow out the flavors. Or just have two. The second one won't seem as strong, I promise.

Cheers,

Jared