Fat Tailed Thoughts: Hello World!

Hey friends -

This is the first in what will become a weekly letter. I find the world to be an endlessly exciting place. Pandemic life stymied my conversations with each of you exploring mostly useless knowledge and musing on an ever-widening range of topics. I hope these letters spark conversations we might not otherwise have had and perhaps leave you thinking a little differently about the world.

Before we jump in, a bit of orientation on what’s to come. Each letter will explore 1-2 topics centered on growth and change - what does the growth curve look like, what are the underlying drivers, and what might be the implications. You'll find topics ranging from business and economics to biology and the natural world. Many of these will seemingly be off the beaten path before they’re tied back to the more familiar and relevant. Each letter will close with a wide-ranging assemblage of facts, figures, articles, and a weekly cocktail I've been making that week.

Please do reach out to continue the conversation. I’m also enormously appreciative of thoughts for future topics, advice on how to make this improve these letters, and cocktail requests. Replying to this email is the best way to get to me.

Now without further ado...

In this week's letter:

Why the technology powering Bitcoin, Ethereum, and Dogecoin will change the world

Cities are seeing massive population booms, it’s just not you and me moving in

Facts, figures, and links to keep you thinking over a drink

A drink to think it over

Total read time: 11 minutes, 50 seconds.

What is a blockchain and why should I care?

Bitcoin is back! Bitcoin first made headlines in 2017 as the price increased 2000%+ in a single year. Now it's back in vogue and the media has started reporting on Ethereum, Dogecoin, and a whole variety of other cryptocurrencies. With little else to report on other than price movements, we’re left with deeply insightful graphics:

I'll leave price movement commentary to Jim Cramer and the media. My opinion is similar to Pierpont Morgan’s apocryphal opinion on the stock market: "it will fluctuate." Let's instead take a look at the technology that underpins crypto - blockchain - and what it might mean for the future.

A spreadsheet we can all agree on

Let's imagine Timmy and Billy are roommates and wanted to split the monthly rent. Timmy pays the rent and Billy reimburses Timmy. Timmy banks at Chase and Billy banks at Bank of America. Without handling physical cash, how can they split the rent?

One answer is to use a service like PayPal's Venmo. We can think of Venmo as a massive spreadsheet. When we say Timmy and Billy have Venmo accounts, we can treat those as columns on the spreadsheet. when Billy sends Timmy $500 for his part of the rent, Venmo subtracts $500 from the Billy column and adds $500 to the Timmy column. This works as long as both Timmy and Billy use Venmo, and we trust no one manipulates the numbers on the spreadsheet.

A second answer is for Billy to instruct Bank of America to send money to Timmy at Chase. Now we have to deal with two spreadsheets - the Bank of America spreadsheet and the Chase spreadsheet. The Bank of America spreadsheet also has two columns, a Billy column, and a Chase column. When Billy instructs Bank of America to send $500 to Timmy, Bank of America subtracts $500 from the Billy column and adds $500 to the Chase column. Bank of America includes a note for that says, "Dear Chase, this money is for Timmy." Chase receives that note and updates the Chase spreadsheet. They subtract $500 from the Bank of America column and add $500 to the Timmy column. Even though we've doubled the number of spreadsheets we need to keep track of, this has the advantage of allowing Timmy and Billy to exchange money even though they don't have accounts at the same place.

Blockchain allows us to have our cake and eat it too. Everyone can be on a single spreadsheet even if they have accounts in different places. But this introduces two novel problems - who is going to update the spreadsheet and how do we make sure they don't manipulate the numbers?

Enter cryptocurrency.

Cryptocurrency instead of gold stars

Let's turn Billy into a bad guy for a moment. Billy is going to fake that he's paid Timmy. How could we imagine him cheating?

One way to cheat is that he tries to send money he doesn't have, like writing a check even though there's no money in his account. When we update the shared spreadsheet, we'll check that Billy has enough money in his account.

Maybe Billy tries to send the same money to two different people. If the checker isn't fast enough, Billy just might be able to spend the same $500 in his account in two places at once. We'll need to check to make sure Billy doesn't double spend his money.

It might not just be Billy that's a bad guy, maybe Timmy's in on it too. We should double-check that Timmy's account is real.

This sounds like a pretty simple computer program: check that Billy has the money, check that he hasn't already spent the money, and check that Timmy is real. Running the program makes sure that Timmy and Billy don't manipulate the shared spreadsheet we're all using. But that still leaves us with the second problem - who runs the program. We don't want Timmy and Billy to be able to bribe the person running the program.

We could make life difficult for Timmy and Billy if lots and lots of people also ran the program. That'd be a lot of bribes and be prohibitively expensive. This is an elegant solution to our "who to trust" problem. We won't trust anyone in particular and instead trust that the lots of people collectively keep the shared spreadsheet up to date and free from manipulation. Unfortunately, we've replaced our "trust" problem with a new problem - freeloading. There's no reason to run the "checker" program myself if I know everyone else is already doing it. We need a way to pay the checkers.

Cryptocurrency is how we pay the checkers. Rather than pay all of the checkers, we'll run a competition. At regular intervals, checkers have to review the most recent "block" of transactions on the spreadsheet and then solve a math problem. The first checker to review the transactions and solve the math problem sends their answer to the other checkers. If the other checkers agree that they got the right answer, we'll pay the first checker in cryptocurrency. If this was elementary school, we'd probably give them a gold star instead. If you've ever heard the term "mining" and didn't know what it was, you've now got it. It's the checkers checking the spreadsheet and solving a math problem to try to win cryptocurrency. The checkers are known as "miners."

This specific way of running a competition to payout cryptocurrency is called Proof of Work. The checkers use a huge amount of computing power to solve the math problem, and the correct answer "proves" they did work to find it. Bitcoin and Ethereum both use proof of work today. There are many other ways of running a competition, and new ways are being invented all the time. Ethereum is updating the Ethereum blockchain to Proof of Stake. The Chia blockchain just launched with a novel idea called Proof of Space and Time. These are all different methods to pay the checkers and each comes with its own tradeoffs. It's a lengthy topic for another letter.

A really slow, expensive computer

The bitcoin blockchain is relatively simple. It's one spreadsheet and it only allows Timmy and Billy to send Bitcoin from one account to the other. Every time they send Bitcoin to one another for rent, they pay the checkers some Bitcoin to process the transaction. The checkers check the spreadsheet and solve a math problem at regular intervals to try to earn even more Bitcoin.

It turns out we can store more than just “Timmy paid Billy” on our spreadsheet. We can use our spreadsheet to store and process 1's and 0's just like a computer. By combining the 1’s and 0’s in the right order, we can turn our blockchain into a computer that is run concurrently by all of the checkers. We can start writing programs for our new blockchain computer, just like we would for a desktop or a mobile phone.

Our shiny new blockchain computer comes with some drawbacks: it’s very slow and very expensive. It's slow because we have to wait for the checkers to agree on the updates at regular intervals. It's expensive because we have to pay the checkers every time we want to use the computer. It's a bit like if we wanted to use the calculator on our cellphones and every time we added two numbers, the cellphone took 5 minutes to calculate and charged us $0.05. Not great.

Cellphones were built for Pokemon Go

This isn’t the first time we’ve invented a new terrible computer. Cellphones are also pretty terrible computers. They have little memory and little processing power, so most of the features have to be in the cloud. Running programs in the cloud means you have to be online or connected to cell service for the phone to really be useful. That's a pretty big pain.

And yet, Pokemon Go was released for your cellphone, not for your desktop. Pokemon Go would probably run better on your desktop computer. The desktop has better graphics and faster response time. But the reason for mobile is obvious - it'd be inconvenient to walk around with your desktop to catch Pokemon, not to mention you'd look ridiculous. The fact that a phone is mobile overwhelms all of the "bad computer" features and is a better platform for Pokemon Go. The premise of blockchain is that it has some really cool features despite all the tradeoffs. If you give the innovators building new blockchains enough time, they might just come up with something amazing.

We're almost 40 years into the mobile revolution. The first commercially available mobile phone weighed over 2 pounds, took 10 hours to charge, and gave you just 30 minutes of use. It took years and new technological breakthroughs to go from a 2-pound phone to the Motorola flip phone to the iPhone. We're just 13 years into blockchain and it’s going through a similar evolution. The key insight to understanding the potential of blockchain is to focus on what makes blockchain novel, not all of the hard problems that have to be solved. Blockchains are "trustless" computers - anyone can help run the computer and everyone who participates can trust the system that no one is cheating. That’s a truly wild idea and we’re just beginning to imagine how it might be used.

There remain many hard challenges to solve before blockchains will be truly transformative; just search for Bitcoin energy consumption and you'll see the raging debate about the costs of Proof of Work. Mobile phones too faced and overcame hard challenges before they were truly transformative. It took years of battery development to improve the charging time and the amount of charge, and just as many years to miniaturize the components so we could fit more memory and processing power in such a small device (that whole Moore’s Law thing).

For a moment, look past the near-term challenges and focus on long-term potential. If everyone can run the computer and get paid to do so, what does that mean for cloud computing like Amazon Web Services? If anyone can send money to anyone else without going through a middle-man, what does that mean for the banks or Western Union? If I can transfer money, can I transfer stocks without a middle-man? What does that mean for the stock exchanges?

These are big questions and they’re probably not even the right ones. Like the iPhone and app store, entirely new businesses will be built on blockchains that we can’t even imagine now and that can’t exist without it. Give blockchain time and it'll change the world.

An American success story

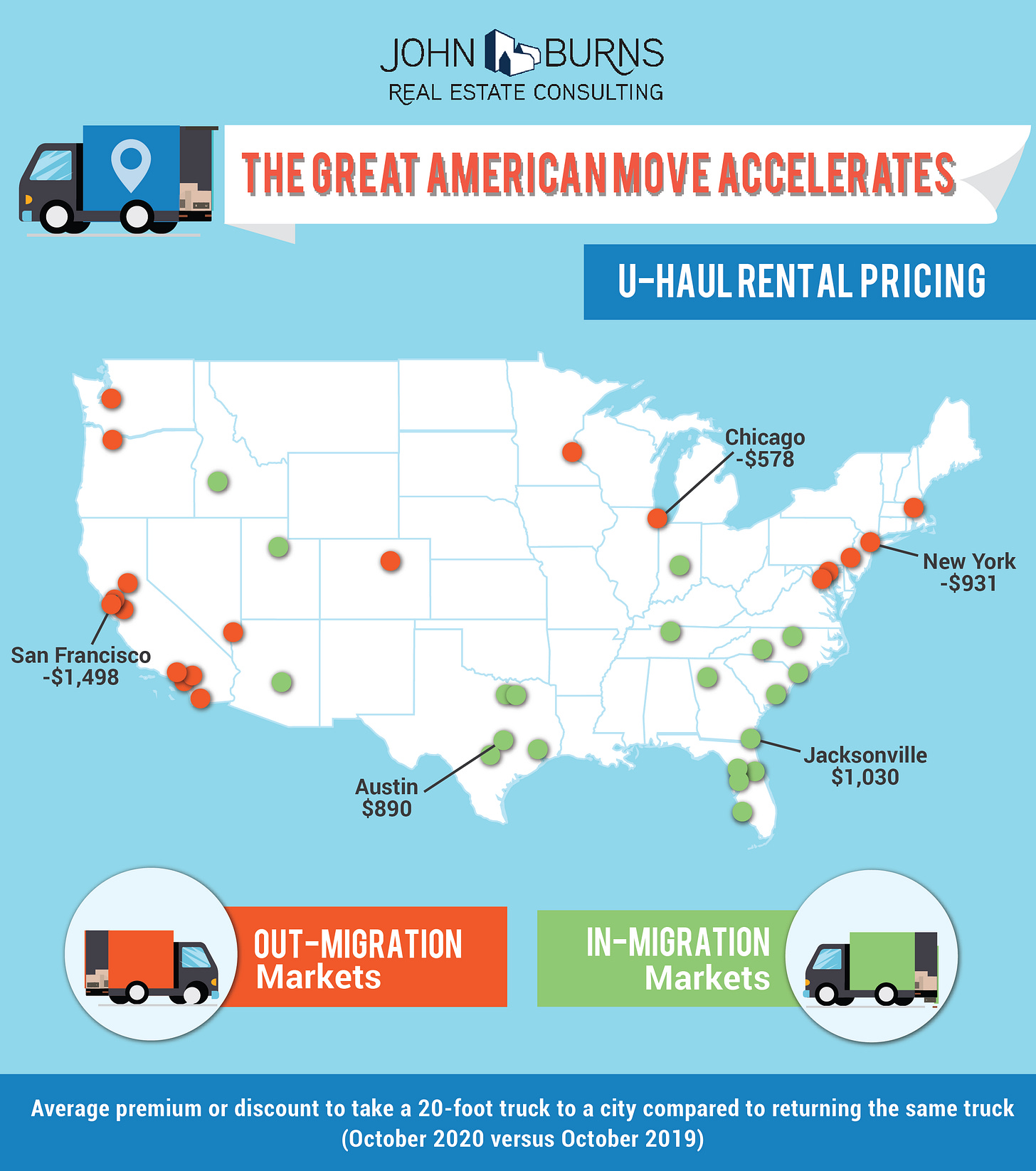

The last few weeks have seen a series of great analyses about US migration out of cities and into suburban areas. The New York Times concluded that the pandemic accelerated trends that were already happening. Areas with inflows had more inflows, areas with outflows had more outflows. Bloomberg concluded that even though trends accelerated, most of the movement stayed within the metro areas. People didn't abandon New York and San Francisco so much as they moved just outside the main city. MyMove took an entirely different angle to dig into why people were moving. Taken together, it's a fascinating exploration of how the same USPS "change of address" data can lead to a wide variety of conclusions. But they all missed the main story.

Raccoons.

While the US people population doubled from 1940 to 1980, the US raccoon population grew by 15-20x. As we've been busy moving out of cities, raccoons have been busy moving in. There are typically 10-20 raccoons per square kilometer in non-urban habitats. In cities like Washington DC, it can be closer to 125 raccoons per square kilometer. Just like any good American success story, raccoons made their way abroad. The German raccoon population has been doubling every 5 years for 90 years, and now tops 1 million. Not content with Germany, raccoons have expanded into Madrid, the Antilles, Japan, and just about everywhere in between.

It's not just raccoons. Cities can be phenomenal habitats for a wide-ranging variety of species. Some of these, like pigeons, we brought to cities ourselves and they've since taken on a life of their own. The modern pigeon is descended from rock doves living in rocky coastal cliffs that we domesticated 5000 years ago as a food source. Pigeon populations soared as we realized their utility for carrying messages and began to breed them as hobbyists. Our urban habitats nicely approximate the coastal cliffs of the pigeon ancestors' habitat, and there are now over 400 million pigeons worldwide. Dogs are a similar story. Best estimates peg free-ranging urban dog populations at over 200 million.

Other species found cities on their own. I expect we’re already more aware than we’d like to be that cities have become a major home to rats, cockroaches, and the like. Less frequently seen or discussed, large animals including major predators have also found cities to their liking. In New York City, peregrine falcons populations have boomed in recent decades. The city now hosts the densest population of peregrine falcons in the world as they prey on over 75 species of other birds. This new habitat has meaningfully helped the falcon recover from a 1960s population crash due to DTT pesticide.

The overriding theme among successful urban species is adaptability. Truly omnivorous animals, often intelligent and curious, have tended to thrive in urban areas. The ever inquisitive macaque monkey is a prime example. Lopburi, Thailand is home to just 60,000 people, but over 4,500 macaques. The macaque population has grown so rapidly in recent years it has become a real problem leading Lopburi to sterilize of 900 of the monkeys in 2020 alone.

Macaques and other omnivores often become prey for coyotes, leopards, and other apex predators. Big populations of omnivores inevitably support big populations of predators. The 2013 coyote population in Chicago was over 2,000 individuals, and multi-million person city Jaipur, India supports one of the highest densities of leopards in the world.

Next time you're wandering through a city, take a look around you. We're building cities for ourselves, but we inadvertently built an entirely new habitat for many other species. Their populations are growing rapidly, often outpacing ourselves, as they discover that they're quite happy making cities their home.

Cocktail Talk

To put the scale of the recent crypto hype in a bit of perspective - in early May, the total value of crypto eclipsed the value of US dollars in circulation

That 71% US population growth from 1940-1980 was remarkable in its own right - it reshaped the country. California's population grew 340%, way outpacing New York's 35% growth, and led to California overtaking New York as the most populous state in the country.

As the weather gets warmer and you think about a weekend outing to go strawberry picking, remember to keep your eye out for 17th-century pirate booty.

In completely unrelated news, I learned that octopuses have 3 hearts. One for pumping blood around their body, and two to pump blood to their gills. And if that wasn't odd enough, they bleed blue.

Your Weekly Cocktail

The weather's finally turned for the warmer but the evenings can sometimes be a bit cold for tiki drinks. An aged rum takeoff on the classic Manhattan bridges the gap.

Springtime Christmas

2oz Bully Boy Rum Cooperative Volume 1

1oz Carpano Antica Formula (sweet vermouth)

2 dashes King Floyd's Ginger bitters

2 dashes Bittermens Xocolatl Mole bitters

Pour everything into a mixing glass. Fill 2/3rds full with ice (until the ice comes over the top of the alcohol). Stir for 30-45 seconds, ~50 revolutions. Strain into a glass. Garnish with a lime wedge. Drink neat.

This is a personal favorite to close out the day. It's all about the baking spices. The rum is deeply molasses. Carpano Antica is unique among vermouths and distilled with vanilla beans. The ginger gives it a bit of a bite and chocolate mole bitters round the drink out. It's a bit like a sticky ginger cake in a glass.

Cheers,

Jared