Fat Tailed Thoughts: Long & Short of Stock Performance

The stock market had an abysmal January. It's a blip in the long-term performance of the market but may lead to perverse investment manager behavior in the next 11 months.

Hey friends -

The stock market's been doing a remarkable amount of bouncing around of late and mostly trending downwards. In January alone:

The S&P 500 lost 5%+, its worst start to a year since 2009

The Nasdaq Composite lost 9%, its worst start to a year since 2008

The Cboe Volatility Index - a popular measure of how much prices change - is up over 50%

It's enough to make your head spin. It's also an opportune starting place for two important questions:

Is any of this normal?

What will happen from here?

In this week's letter:

Historical context for stock market returns

When managing other people's money becomes heads I win, tails you lose

Chip shortages for the foreseeable future, practical recommendations to tackle inflation, and more cocktail talk

A throwback cocktail from a different era, the Three Storms Flip

Total read time: 11 minutes, 9 seconds.

What is a Normal Stock Market?

The stock market has averaged about a 10% return per year for around 100 years.

You'll find similar statistics in the investment mandates for pensions and non-profits to justify investments in stocks. You might even see it manifest as a targeted return, such as in the case of CalPERS, the largest public pension fund in the country:

> If we were to take a long-only portfolio and try to achieve a number like 6.8 percent [our return target] we would put everything into some sort of equity.

It's true - the market has averaged about a 10% return - but the statistic is misleading without more context.

Few of us have 100-year investment horizons

It doesn't tell us anything about the distribution of returns

We don't know if the next 100 years will look the same

We have to look at all three before we can answer if today's market is "normal."

Time horizons & starting points

The starting point for measuring returns can materially affect the end result. Longer time horizons help counter the effect, but they don't eliminate it completely.

Let's look at two examples starting with the stock market returns this century.

The 90s dot com boom didn't end until the year 2000, at which point the market crashed. The market then crashed again during The Great Recession in 2008-2009. Depending on where we start our measurement, we get very different results.

If you start the clock on January 1st, 2000, the returns for the first 13 years of the 21st century are essentially zero. If you account for inflation, returns are zero through the end of 2014. But if you start the clock in 2002 - after the dot com blow up - returns are more attractive.

That results in two seemingly incongruous statements both being true:

Returns in the 21st century have been poor - just 5.5% per year

Returns over the past 20 years have been good - over 7% per year

While the difference between the two may seem small, compounding reveals the true impact. If you started investing in 2000, you would have tripled your money by the start of this year. If you started in 2002, you would have quadrupled your money. Start even later - when the market finally bottomed in 2003 - and you would have quintupled your money.

Which version you hear likely depends on what you're being sold. Just look at the ad from Masterworks.

Why start measuring returns from 1995? It tells a compelling good story.

Similar dynamics can arise even when measuring over very long periods. The stock market crash of 1929 was severe enough that it significantly alters our return measurements.

The average return over the last 100 years is 10.82%, but it drops to 9.78% if we start in 1929. That's the difference between a $100 investment turning into $2.8 million or just $0.6 million, a 4.5x difference.

The starting point matters a lot for how we think about returns.

Anything but normal

Averaging 10% a year doesn't tell us anything about how returns are distributed.

We instinctually assume that most distributions - like the annual stock market returns - are normal. It's a good assumption for many aspects of life. Height for instance is normally distributed.

The average male is 5ft 10in tall. 68% of men fall within three inches of the average, one standard deviation. Expand the range to six inches around the average - two standard deviations - and it accounts for 95% of the population. There are no humans 6 inches tall or 12 feet tall.

Stock market returns are not normally distributed. Our heuristic that most distributions are normal will lead us astray.

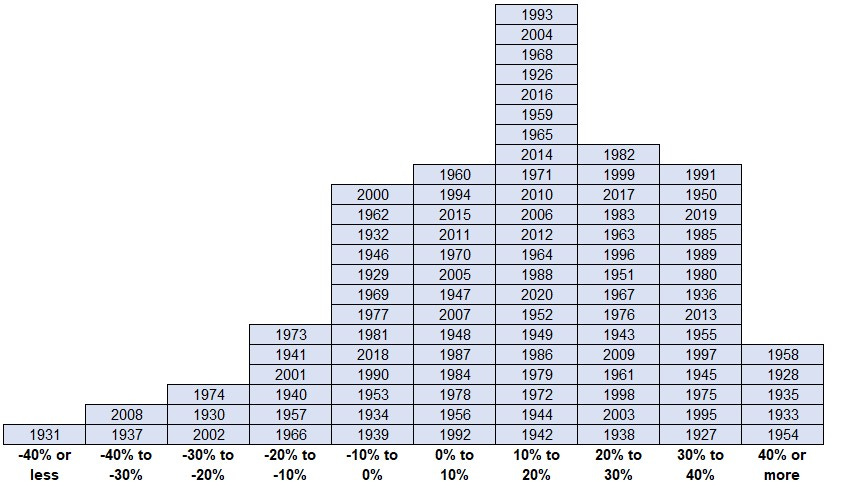

Annual returns have been in the 8-12% range in just five years since 1926. That's the same as the number of years in which the market returned over 40%. There's even more funkiness:

Over 40% of the years saw positive or negative returns greater than 20%

About 50% of the years in which returns were negative saw a loss of more than 10%

Returns in almost 75% of the years were positive

These types of dynamics are not typically what you'd expect when you read "an average of 10%." Stock market returns for any given year are likely to be far away from the average.

The next 100 years

We don't know what the next one hundred years will bring, but we can still plan.

In the depths of the market crash in 2008-2009, Howard Marks wrote a memo on "The Long View." He identified five long-term drivers that have underpinned stock market performance for over 70 years. I've summarized them below:

Macro environment - the US population grew and no wars reached our shores. Modern infrastructure, strong education and healthcare systems, and gains in technology all contributed to growth.

Corporate growth - companies and their profits grew alongside strong consumer demand. The world bought American products and services.

The borrowing mentality - access to debt increased alongside company, consumer, and government use of debt to fuel growth.

Popularization of investing - investing in the stock market grew from being a novelty to a mainstream phenomenon. Successful investment managers became rock stars.

Investor psychology - investors forgot the stock losses incurred during The Great Depression and learned that the stock market produces high returns over time.

We could debate each one of these in turn. Some - like access to capital - have grown from strength to strength. The US venture capital industry is the envy of the world. In 2021 alone, venture capitalists invested $269 billion into startups, almost twice as much as the next five countries combined.

Others, like education and healthcare, have fallen behind. US student testing scores continue to decline against countries around the world while healthcare costs balloon despite minimal improvements in quality.

Taken as a whole, these drivers collectively will continue to underpin strong US performance on the global scale for years to come. That doesn't mean individual drivers won't wax and wane or that it will be a smooth, uninterrupted ascension. But it seems more probable than not that the US will continue to be the world leader and that its growth will translate to attractive stock market returns over the long run.

So is today's market performance "normal?"

In short - yes. What the market is doing is "normal."

The market fluctuates significantly around an attractive long-term average return. Staying in the game remains an attractive long-term proposition.

But that's little comfort to most money managers. They're measured on annual performance.

Other People's Money

We said the starting point matters a lot. Nowhere is that more true than for the performance measurement of money managers.

The successes and failures of money managers are expressed in calendar year increments. "So and so returned 35% last year." "That's a lot better than other person. They trailed the market by 12%."

This isn't idle chatter. It underpins which money managers investors trust with their portfolios.

It can also lead to perverse behavior.

Heads I win, tails you lose

Consider a hedge fund manager. They've tried to align their incentives with their clients such that they only make money when they help their clients make money.

The hedge fund manager sets up a fund where they charge investors 1% of assets under management and 10% of profits. The fee on assets under management helps pay for general expenses. The profit fee is where the real money is made.

The manager goes further. They put in place a hurdle rate where they only collect the 10% fee on profits above an 8% return a year. They also put in place a high-water mark - if the fund has a bad year and loses investor money, they have to make back the investor money before they can start to collect the profit fee.

It's a healthy arrangement on paper. The manager is making a sincere effort to only get paid if they really do earn money for their clients. But it can lead to truly terrible outcomes.

The S&P 500 ended January down 5%. Let's imagine our hedge fund manager was down the same amount. They have 11 months left to generate at least a 13.6% return to start earning their profit fee. This is more than the 5% loss plus the 8% hurdle. The magnitude of the gain will always be bigger than the magnitude of the loss just to get back to even. Think about if the hedge fund had lost 50% in the first month - it'd require a 100% gain to get back to even.

It's harder to generate a 13.6% than it is to generate an 8% return. If the fund manager goes down another 5% in February, they'll have to produce a 19.7% return and will have just 10 months to do so. That's even more difficult.

The fund manager wants to do the right thing for their clients, but the "alignment of interests" incentive structure incentivizes the wrong behavior. If the market has a bad year and the manager continues to match market performance, they'll start the next year in a hole. Because of the high-water mark, they'll have to generate strong enough returns to fill in the hole and an additional 8% before they start collecting the profit fee again. If the hole is deep enough, the manager is probably better off closing down the partnership and "resetting" the performance measurement with a whole new group of investors.

If the manager wants to generate a profit fee this year, they will need to produce spectacular returns. Excessive risk-taking is the probable method. Risk may lead to a greater probability of spectacular returns, but it also leads to a greater probability of larger losses that will drive the manager to shut down the fund. We're right back to the first scenario, but the manager lost even more investor money.

The manager is highly incentivized to swing for the fences. If all goes well, they make up the losses and collect a profit fee. If all goes poorly, they shut down the fund. The investors lose in both cases. Even if the excessive risk-taking generates better returns this year, it won't be on a risk-adjusted basis. That strategy will likely blow up in the long run.

The essence of misalignment of interests stems from the very same dynamics we detailed earlier - stock market returns are highly variable year to year and a calendar year measurement period is arbitrary. It doesn't matter how well the manager did the year prior. All that matters is this year's performance.

What can be done?

If you have money invested with a manager, pay close attention to the incentive structure. Your manager is likely well-intentioned and wants to help you grow your investments. But they're also human and will struggle to combat poorly aligned incentives.

Changing the measurement period from a year to something longer doesn't solve the issue. If the manager is measured over multiple years and takes significant losses early in the measurement period, they may be better off shutting down the fund and trying again.

One alternative approach is for fund managers to lock up investor money for long periods, even going so far as to create permanent capital structures where investors cannot request their initial investment back. While it affords the investment manager a longer time horizon over which to generate returns, few investors are prepared to invest in such structures and even fewer managers have earned their trust.

In short, it's a hard problem. Even if we can't fix it, we can profit from it.

This isn't advice to buy stocks right now or even ever. It's an observation that there is almost $5 trillion of other people's money managed by hedge fund managers. Many of those managers are in a position where they may be personally better off - short-term at least - making the wrong choices on behalf of their investors. Not all will succumb to temptation, but undoubtedly some will.

In the coming months, these fund managers will swing for the fences in an attempt to make up for their losses. Some will drive up the prices of companies way beyond what they're worth. Others will buy stocks on margin as prices continue to fall and find themselves forced to sell to pay off the debt. That'll drive prices even lower. Such excess may result in a meaningful discrepancy between the price of specific companies and their actual value.

Their folly can be your opportunity.

Cocktail Talk

ARK Innovation ETF and its manager Cathy Wood were the darlings of 2020. Despite spectacular returns for four consecutive years, the average dollar invested in Ark has now lost money. What happened? The spectacular returns were generated when the assets under management were in the tens and hundreds of millions. The great returns through the start of 2021 resulted in billions of dollars of inflows into the fund. Returns crashed right as inflows peaked. It's a good - albeit painful - lesson in mean reversion especially as small portfolios get larger. (SL Advisors)

Computer chip shortages are going to be with us for years to come. It was the perfect storm years in the making. Manufacturing volumes are growing, but it takes years to build new manufacturing capacity. In the meantime, demand is accelerating while supply chain disruptions and continued geopolitical unrest in Taiwan, the primary manufacturer, are adding to the already difficult situation. From cars to autonomous robots in warehouses, chips are fundamental to everything "tech" enabled. We're just starting to understand the full implications of the shortage. (WSJ)

It can be difficult to find non-partisan, non-monetary policy recommendations for how to tackle inflation. Two of the Tuck School of Business's finest managed it. They recommend three non-nonsense and immediately actionable ideas: declare a tariff holiday, expand the number of H-2B visas, and expand the number of H-1B visas. It's an attractive combination of reducing prices through the tariff holiday and lowering production costs by expanding the pool of labor. (Tuck School of Business)

Have you ever tried to arbitrage gold coins? It must have been all the rage in England in the mid-1200s. Henry III attempted to introduce a new gold penny to his realm in 1257. Despite printing over 72,000, only eight pennies have survived to the present day. It seems that the king failed to account for an appropriate conversion rate to the already prevalent silver penny. His subjects realized that the gold penny was worth more melted down and sold as gold than it was as a coin. And so went the overwhelming majority. (Moneyness)

Your Weekly Cocktail

Going old school with the flip.

Three Storms Flip

1.75oz Bully Boy The Rum Cooperative Vol. 1

1.00oz Falernum

0.25oz Laphroaig 10 Year Single Malt Whisky

2 dashes Orange Bitters

1 pinch Salt

1 pinch Pepper

1 whole Egg

Nutmeg

Add all of the ingredients to a shaker. Add ice until it comes up over the top of the liquid. Shake vigorously for at least 20 seconds. Strain into a coupe glass and dust with nutmeg.

Flips fell out of fashion even before the prohibition era. Their heyday was the late 1800s when they featured prominently in taverns across the US. Only the flip's close cousin, eggnog, survives to this day with any popularity. The inclusion of egg yolk imparts sweetness and creates a much richer texture than is typical for modern cocktails. The combination of rum, Falernum, and spice is the base for many a tiki drink. Flip and tiki together result in a wonderfully fun drink that, while probably not part of any regular rotation, will surprise and delight even the most seasoned cocktail enthusiast.

Cheers,

Jared