Fat Tailed Thoughts: Back to the Futures

What if we went back in time and canceled all of our unprofitable trades? For one 145-year-old institution, that seems to be the strategy.

Hey friends -

The news is rife with stories of how big, bad Wall Street takes advantage of the little guy, of how the odds are impossibly tilted in the favor of the entrenched elite. It's the type of narrative that - when taken to an extreme - gives rise to conspiracy theories of how famed investor George Soros secretly controls the world.

Rarely do we hear the stories of when Wall Street itself is taken for a ride, when the "entrenched elites" become the little guy.

Welcome to the nickel market.

In this week's letter:

How the largest metal futures exchange in the world appropriated $1.3 billion from traders to bail out its patrons

The economics of book publishing, home design as a secret weapon against carbon emissions, and more cocktail talk

Almost a “mother sauce” cocktail, The Last Word

Total read time: 11 minutes, 24 seconds.

Heads I Win, Tails You Lose

Cliff Asness is as close to a "master of the universe" on Wall Street as you'll find.

And he's the loser in this story.

Twice Cliff has co-founded among the all-time best performing hedge funds. His more recent, AQR, has since expanded to become a full-service investment firm with $143 billion under management. Cliff himself is worth many billions.

But even he can make mistakes.

You see, the price of nickel has been on a tear since Russia invaded Ukraine. The metal is a critical component to produce stainless steel and car batteries. Russia is the world's largest exporter.

But not everyone in the market believed that the price would go up indefinitely. Some were short, that is, they would make money if the price of nickel fell. Being short always comes with risk - the price of nickel can go up indefinitely and your potential losses are infinite. No exchange will let you take on that risk without offsetting it along the way. You're required to put up collateral (called margin) in case you can't meet your obligations. As the price increases, you're "margin called" and required to put up even more collateral to offset the larger expected losses.

If the price moves up too much and you want to stem the losses, there's a way out of the trade - purchase an offsetting contract. You can take a long position that counterbalances your short position. You make and lose no further money as the price moves.

Most of the time, this system works "as intended." Firms can bet on the future price of nickel and execute offsetting trades to hedge their losses if the price gets too far out of wack. But sometimes, it spirals.

Cliff and others recognized that there was an imbalance in the market. Some market participants were short the price of nickel right as much of the supply threatened to be cut off due to Russian sanctions. That would drive the price up. Traders with short positions would get margin called and have to put up more collateral. Many of them would try to make offsetting bets to stem the losses, which would drive the price of nickel higher.

It's the perfect makings for a short squeeze. The price of nickel wouldn't just go up because of Russia, but also as traders with short positions tried to cover their losses. Cliff and others could go long nickel to get the ball rolling. They stood to make good money as the price went up.

In the six months between September 2021 and February 2022, the price of nickel rose 20%. In two days in March, it skyrocketed 250%.

Hell of a bet. That is until the exchange intervened. On March 8th, the exchange reversed all of the trades and shut down trading.

The traders with short positions were bailed out - they no longer owed money. Cliff got zilch. Never one for subtlety, he's been rather vocal in the aftermath.

Futures & Forwards

We need to take a deeper look at how futures and forwards markets to start to make sense of what happened.

A forward contract is an agreement to buy or sell an asset at a future date for a price agreed upon today. What it means in practice is that if the price at that future date is higher, then the buyer comes out ahead. If the price is lower, then the seller comes out ahead. The contract can either be physically settled - actually exchanging the asset - or cash-settled for just the price difference.

Forwards are a particularly useful invention. Imagine you're a farmer and you sell wheat. You plant your winter wheat in the fall hoping in anticipation of selling it in the summer. No one knows what the exact price of wheat will be in the summer, but you know that you need to generate a certain amount of revenue to support your family and pay for next year's seed. A forward contract allows you to do that - lock in a price today for delivery of wheat in the summer. On the other side of the trade might be a baker who wants the same price certainty for one of their major expenditures.

There's risk that either the farmer or the baker will fail to uphold their end of the deal. If we left the contract as is, it'd stay a forward - the contract doesn't settle until the agreed-upon date, the contract terms like the amount to be exchanged is likely custom, and the two participants are exposed to the risk that the counterparty defaults. Futures are the close cousin of forwards - they solve all of these challenges.

Futures are traded on exchanges using industry-standard contracts and settle daily. There are many risk mitigations, starting with daily settlement. If the price on any given day moves too far away from the agreed-upon price between the parties, the exchange requires the party likely to take significant losses to put up more margin. The initial margin and the magnitude of the price movements that trigger margin calls are both parts of the exchange design.

Behind the exchange sits a centralized clearinghouse, another key risk mitigator. While we express a futures contract as being "between the farmer and baker," it actually gets implemented as two separate contracts. One contract between the farmer and the clearinghouse, and the other between the baker and the clearinghouse. That insulates both parties from the potential default of the other - the clearinghouse takes that risk.

That's a pretty good setup. Forward contracts expose the two parties to the risk that the counterparty defaults and where the deal terms - like margin - are custom. Futures insert a centralized clearinghouse to eliminate counterparty risk and standardize deal terms, including requiring daily settlement.

The main incentive for firms actually doing business in the underlying goods being exchanged is straightforward: they want to hedge future prices. But what about the incentives for the pure-play financial actors, like whoever is taking the other side of the forward contract or the exchange?

Forwards counterparties

More often than not, the counterparty to a forward contract is going to be a financial actor. They have the sophistication and balance sheet to manage the risk.

Four major US banks participate in the market - JP Morgan, Bank of America, Citibank, and Goldman Sachs. As of 1Q21, they held over $33 trillion of futures and forwards, 80% of all futures and forwards held by US banks. Of that total, almost $30 billion is forwards, meaning they're taking on that the counterparty defaults. That astoundingly large number materially overstates the risk that they take on but helps explain their incentives.

The value of futures and forwards are expressed as notional amounts, not net amounts. A bank may be long $1 billion of wheat futures at $9 per bushel and make money as the price increases, but that doesn't give you an insight into their net exposure. The same bank may also be short a $1 billion of wheat futures at $10 per bushel and make money as the price falls. Their net exposure - and risk - is much smaller than the $2 billion notional value would imply.

More often than not, that's exactly the role of the bank - to serve as an intermediary. They're (usually) not in the business of betting on the long-term price trends. Instead, they're serving as a counterparty to someone who needs a custom contract different than what they'll get on an exchange. To hedge the price risk from any one contract, banks look for offsetting trades. They can more precisely offset the price and timing of a forward with another forward. This makes banks a great equalizing force.

But it also leaves the banks with significant residual counterparty risk. Every time they enter into a new forward contract, they take on new risk that a counterparty might default. There are financial instruments that can help reduce the risk, but often there's a simpler answer - don't take on new risk with the offsetting trade. Instead, enter into a futures contract and offload that risk onto the clearinghouse.

Futures counterparty - the clearinghouse

Being the counterparty to every trade comes with serious risk. Anytime anyone defaults, you're left holding the bag. Margin helps but doesn't totally eliminate the risk.

The method to deal with default risk dates back centuries - limit membership and require the members to capitalize a default fund. Limiting membership ensures everyone who is a member feels a true sense of ownership. The jointly-owned default fund provides both protection and self-policing. The model is centuries old and still in use because it works.

Those members, unsurprisingly, are typically the very same banks engaged in forwards contracts. JP Morgan, Citibank, and Goldman Sachs are among the forty-five members of the London Metal Exchange, the largest metals futures and forwards exchange in the world.

Most of the time, that creates a healthy alignment of incentives. The banks are user-members of the clearinghouse. The banks are incentivized to use the clearinghouse as members and the clearinghouse is incentivized to keep the banks as happy customers.

When the markets go crazy - like a doubling of the price of nickel in a day - that can backfire.

Shenanigans at the Exchange

On March 8th, the London Metal Exchange (LME) shut down nickel trading and canceled all $4 billion of the previous day's trades. About $1.3 billion in profits were effectively transferred from the traders with long positions back into the pockets of traders with short positions. The shutdown lasted a full week.

Despite Cliff's outrage, LME has the full power and authority to shut down and cancel trades basically at its whim. Technically, its rulebook states that the "cancellation of such Contract is necessary to... maintain an orderly market," but that's sufficiently broad to be a carte blanche.

The question is why would they do so.

The backstory

Tsingshan Holding Group Co. is a Chinese nickel producer and steel manufacturer. It assembled a 150,000-tonne short position in nickel, more than 2.5x all the nickel that was in stock at LME warehouses in early March. At the peak of the short squeeze, Tsingshan owed over $8 billion in nickel.

Some of that was due in futures contracts. As it so happens, the nickel that Tsingshan produces is of a different grade than what's sold in LME futures. The company would need to procure all of that nickel from elsewhere.

The majority of the nickel was due in forwards contracts that likely could have been met with what the company mines. But the forwards margin calls could not. That requires cash - cash that was being soaked up by futures margin calls and trying to cover the short bet.

CCBI Global is one of the 45 LME members and was the broker for Tsingshan. It took on the risk for Tsingshan's default for the futures contracts, indirectly exposing LME if it too defaulted. That exposure was likely manageable by LME's default fund.

On the other side of the forwards contracts sat three banks - JPMorgan, Standard Chartered, and BNP Paribas. LME had no exposure to any default risk from the contracts, but it's helpful to know that all three banks are also among the 45 LME members.

It's probably also helpful to mention that LME is owned by Hong Kong Exchanges and Clearing. And that CCBI Global banks with state-owned China Construction Bank.

Together, it all looks like this.

Oddly fishy

You can't help but notice that if Tsingshan no longer owed anyone money, problems would go away for everyone except the traders that were long nickel. That's exactly what happened.

All the banks got bailed out from their direct exposure to Tsingshan. LME never had to touch its default fund and saved the banks needing to refill the coffers. The only firms left out in the cold were the traders that were long nickel, but no one else benefited if they profited. So they didn't.

There's plenty of chatter about how such a deal came about and whether state actors were involved. Regardless of how we got here, LME's protestations that canceling trades was "in the interests of systemic stability and market integrity" simply rings hollow. They and their member firms stood to lose massively if the trades stood and they had all the tools they needed to unwind them. So they did.

These are those perverse incentives. The user-member clearinghouse model works until it doesn't. When markets function well, the members pit off against each other as a check on risk and as trusted counterparties. When the markets go haywire, the user-members may act as a block to protect themselves at the expense of the other market participants.

The consequences are only just beginning to unfold.

The aftermath

Trading volumes for nickel fell to a 15 year low at the LME. Volumes for all metals are down over 8%.

Since reopening trading, LME has since set daily limits on price moves, intervening in the market in a manner that the exchange considered unthinkable not long ago. The firm also doubled the size of the default fund, requiring member firms to contribute even more capital. Who knows how the inevitable resulting lawsuits will play out.

LME is a 145-year-old institution, the largest metals futures exchange in the world. We'll see if they still are in the aftermath.

Cocktail Talk

How many messaging apps do you use? I'm now into the double-digits on my phone. It's infuriating. They don't share messages, don't share data, and frankly, I'd be thrilled to get rid of most of them. But I can't - different communities use different apps. Europe is poised to solve the problem alongside a host of other "Big Tech company" issues with the Digital Markets Act. While I'm generally supportive of the effort, I do wonder why Europe doesn't put as much effort into fostering a tech industry as exciting as America's as they do attempting to regulate the one we have today. (Politico)

The business of book publishing continues to go through rapid change. Amazon has multiple times upended the previously highly profitable, stagnant industry first with self-publishing, then with eBooks, and most recently with audiobooks. But with their 80%+ market share has come abuse - Amazon directly regulates the prices self-published books can charge and promotes paid-advertised books ahead of what buyers are actually searching for. Highly successful author Brandon Sanderson is challenging the model with an unbelievable $35 million pre-sale of his upcoming books. His approach takes the best from pricing found in tech - many price points that each offer a different bundle of formats and swag. His strategy - outlined in a recent blog post - is a wonderful insight into both the current state of affairs and how publishing can evolve. Thanks to The Diff for sharing! (Brandon Sanderson)

What will rising interest rates do to fintechs? While rising funding costs will reduce the supply of cheap money, they may also enable startups to offer more attractive services. Banks by contrast will almost certainly benefit as the higher rates they can now charge on loans will increase profitability. The Wall Street Journal and Forbes take opposite sides - each states that one or the other will prevail. It's a good debate, but both overlook a critical insight - fintechs have only ever existed in a low-interest environment. Low rates, venture funding, and government handouts don't breed underwriting discipline. We will soon find out who underwrote responsibly and who is swimming naked. Thanks to This Week In Fintech for sharing! (Wall Street Journal, Forbes)

Design can be a secret weapon in the ongoing efforts to improve energy efficiency. "Energy guru" Amory Lovins designed his own house as a showcase. Despite being located in Snowmass, Colorado, he comfortably grows bananas and other tropical fruits with only a modicum of solar power. It's down to doing the basic well like good insulation and laying pipes straight to reduce heat loss through friction. While I disagree with his predictions for nuclear, his insights into design are powerful. (The Guardian)

Your Weekly Cocktail

A drink that’s given rise to countless others.

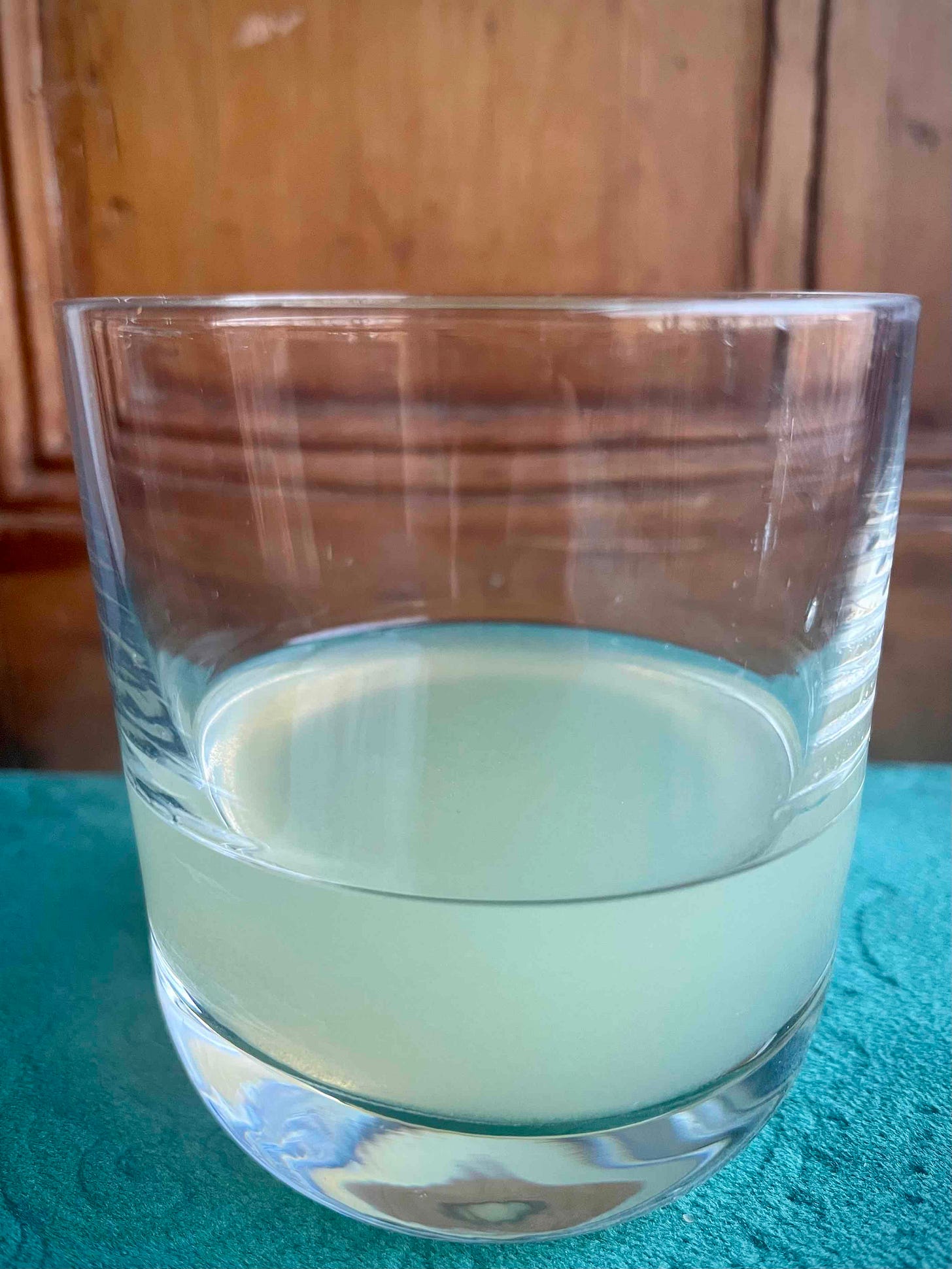

The Last Word

0.75oz Gin

0.75oz Luxardo Maraschino Liqueur

0.75oz Green Chartreuse

0.75oz Lime Juice

Pour everything into a mixing glass. Add ice until it comes up over the top of the liquid. Stir for 20 seconds (~50 stirs) until the outside of the glass is frosted. Strain into a coupe glass (a rocks glass will do if you don’t have one) and enjoy.

I was chatting with my brother-in-law over the weekend about cocktails. He’s a sous-chef a the brilliant Suraya in Philadelphia (go eat there, it’s incredible) and asked if there were mother sauce cocktails. It’s a concept from French cuisine, a small family of sauces from which almost all other sauces are derived. The Last Word plays such a role in the modern cocktail canon. It’s a rediscovered prohibition era cocktail - a tangy celebration of Chartreuse - that’s given rise to countless variations. Everything from rye to mezcal has been swapped in as the lead alongside an ever expanding cast of supporting actors. I’m excited to explore them with you in the upcoming letters!

Cheers,

Jared