Fat Tailed Thoughts: Challenger Approaching, A New Payment Network Has Appeared

Credit card networks have reigned unchallenged for 50 years. But you can now pay faster and cheaper in dollars over crypto networks. The payments revolution has begun.

Hey friends -

There's a quiet revolution happening in payments. It's the first real challenge to the credit card networks in decades. Possibly, the first "real world" use for crypto.

Like many revolutions, this is a story of slowly then quickly. It appears we've made the switch.

In this week's letter:

Challenger approaching, a new payment network has appeared: credit card economics, stablecoin payments, and how the revolution unfolds

Anonymity on the internet, an airplane with no moving parts, and other cocktail talk

The Division Bell, it's a summertime-ready version of The Last Word

Total read time: 11 minutes, 13 seconds.

Challenger Approaching, A New Payment Network Has Appeared

The credit cards networks have gone practically unchallenged since the launch of Visa in 1976. Especially in the US with our 2% cashback and travel reward points, consumers are simply addicted. Credit cards are wonderfully convenient and wildly profitable for almost everyone involved.

We're so in love with credit cards that we don't give much thought to what a ridiculous system it is. Swipe a piece of plastic so you don't actually have to pay today? Earn rewards by taking out a 30-day zero-interest loan? It's a wonder that the system exists at all.

But there is a group that thinks about credit networks a lot. Merchants. They're the ones footing the bill for our enthusiasm.

Joe's Coffee economics

My local Joe's Coffee probably generates about $0.19 in profit per $3.00 cup. Input costs are roughly $0.62: $0.07 for the beans, $0.16 for the exporting, $0.35 for the roasting, and $0.04 for the shipping. The remaining $2.18 of cost is for running the shop.

$0.19 per cup of coffee isn't a lot. If Joe's sells an astonishing one thousand cups of $3 coffee every day, it'll generate just over $1 million in revenue every year. Net, that'll allow the owner to pay herself about $200,000 per year. That's a lot of work and risk for $200,000.

It would be helpful for the business if the owner could increase profits. Costs are mostly market-determined and not in the owner's control. Joe's can't increase its prices because Variety Coffee just opened across the road and is keeping prices low to try to win business. The store also doesn't have the physical space to sell much more than coffee.

But Joe's does have an option - it could go cash only. That might sound like a small change, but it could almost double the profits. Joe's currently pays about $0.18 per cup to Square, its payment processor, which in turn pays most of that to the card networks. If the store only accepts cash as payment, it'll generate an extra $0.18 in profits on every cup. That's another $200,000 a year. Maybe the owner will even start an online blog about "how to double your profits with this one weird trick."

The problem for the owner is that some of the coffee drinkers will defect to Variety and Joe's won't sell 1000 cups a day anymore. Additional profits will be something less than the anticipated $200,000. The cash-only policy may even result in less profitability entirely. Transitioning the business to cash-only is a bet - the money saved from not paying credit card fees will offset the falloff in purchases.

What Joe's really wants is a different system, one where they can accept cards without the fees.

Locked into closed networks

Merchants have a hard time not accepting cards when they first start - the incremental revenue is too tempting. Once they’re among the 56 million merchants that accept Visa, the risk of losing customers keeps them on the network. 56 million is a lot of competitors waiting to offer your customers a convenient payment method if you don't.

When businesses do quit credit card payments, it's usually a halfhearted effort. In years past and still in Europe today, businesses would frequently not accept American Express cards because they charge higher fees. That compromise was tolerable for the merchant because the Amex network is relatively small. Visa by contrast is enormous.

Over $2 trillion was spent by consumers using Visa cards in 2019, more than the next three largest card networks combined. Many businesses simply can't stomach turning away that revenue once they're hooked.

Visa's launch in 1976 was a solution to an amalgamation of hard problems that could only be solved by a single consortium. Among the many networking problems - banks needed to agree to allow consumers to swipe-now-pay-later, merchants needed to agree to be paid later, and banks needed technical standards to exchange cash settlement information between the merchant and consumers. Visa inserted itself at the center of all of these problems and created a massive network of banks, consumers, and merchants who could exchange the necessary payment information for just a small fee.

Visa and its competitors continue to maintain these networks today. It’s been good business for everyone except merchants. Banks make money by lending to consumers who don’t pay off their debts every period. Payment processors like Square and Stripe charge a fee to help merchants connect to the networks. The revenue is so good that the network participants can afford to return some of it back to consumers as cashback and rewards points. All the while, the network operator takes its small slice of an ever-increasing pie.

Visa, Mastercard, and the other networks are all closed networks, islands unto themselves. With banks, consumers, and the networks fat and happy with the status quo, there are few incentives to decrease the network fees. Increases will just be passed onto merchants who can't move off the network, so they go up. The result is that Visa and Mastercard fees today are twice what they were in 2012.

There's an alternative to closed networks - open ones. What's needed is a system that anyone can connect to, where both messages and the payments themselves can be exchanged. That system needs to be maintained not by a single organization, but by many individuals all contributing separately. The code itself should be open-sourced so that there's always the threat of competitor copycats that build better, faster, cheaper versions of the original.

What's needed is crypto.

Crypto Networks Become Payment Networks

Crypto networks are becoming payment networks.

They meet all of the core requirements - open-source, free to connect to, maintained by many individuals contributors, and useful for exchanging both messages and payments. But they come with drawbacks:

They use crypto. Most consumers prefer to pay in fiat currency like dollars. Most businesses prefer to be paid in dollars.

Transaction throughput is poor. The bitcoin network can handle ~7 transactions per second. VisaNet can handle ~65,000 payment messages per second.

They're public. Most consumers and businesses want their payment information to be private.

They're inaccessible to the general public. The user experience is poor. You have to be technically savvy and in the know to use them.

These are real problems. They're also solved problems.

Challenger approaching, crypto's leveling up

Allow me to mix and match the best of the bitcoin and Ethereum networks. Both are using similar solutions to solve these problems in parallel. They're each further along on some solutions and further behind on others.

Consumers and businesses today can transact on Ethereum in stablecoins like Circle's USDC and Paxos's USDP. Each stablecoin is worth exactly a dollar. They're representations of dollars and short-term government securities held in FDIC-insured accounts and segregated custody. Holders can redeem their stablecoins with the issuer for physical US dollars at their leisure.

Cryptocurrency networks are not free to use. Every transaction incurs a fee paid in the native currency of that blockchain. Those fees can be expensive when networks get congested. That’s a serious adoption hurdle.

Ethereum and bitcoin both solved the problem with parallel networks. On Ethereum, there are layer 2 networks like Polygon that only write some of their transactional data to the parent Ethereum network. It's able to reduce transaction costs to a few cents or less, almost small enough that an intermediary could offer a service that pays for crypto-denominated transaction costs in return for stablecoin dollars. That allows network participants to only handle stablecoins.

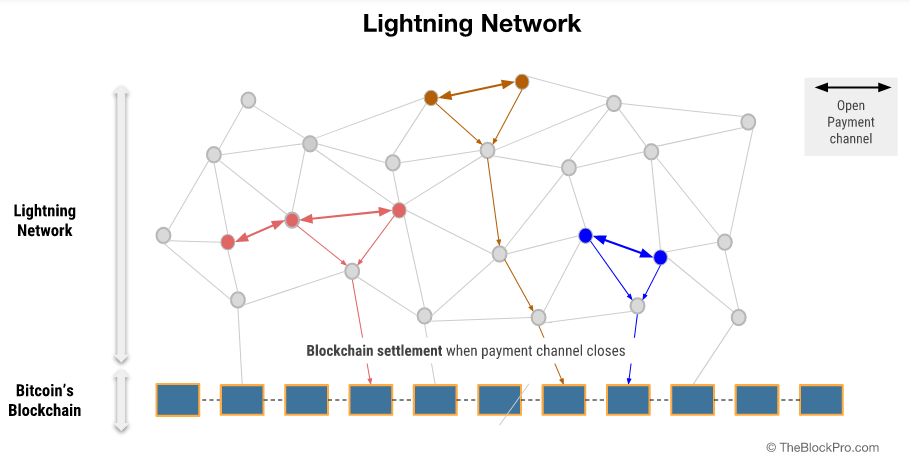

Bitcoin's layer 2 solution - the Bitcoin Lightning Network - is even cheaper to use. Transactions cost fractions of a penny. Companies like Square are already paying the transaction costs on behalf of their users when they use the network.

These layer 2 parallel networks also solve the second problem with crypto networks - throughput. Bitcoin's limited to seven transactions per second. The Bitcoin Lighting Network can process millions of transactions in the same period.

Throughput comes at a cost. Faster networks are often harder to secure or are more centralized, a tradeoff known as the impossible triangle of blockchain. VisaNet solved throughput by centralizing the network. The crypto layer 2 designs acknowledge the lack of security and instead minimize risk - net transactions are settled to the slower but more secure parent blockchain at regular intervals. The amount of value at risk at any one time in the less secure layer 2 networks is kept to a minimum.

Details of transactions on the parallel networks need not be public. Participants on the Bitcoin Lightning Network only need to know about payments to and from the other participants with whom they're directly transacting. There's no underlying ledger storing details of every transaction. Participants are just exchanging claims on Bitcoins on the bitcoin network. As long as you can validate that the claim is real, you don't need to know anything else. The only public data is the net settled amount between two "source" parties on the bitcoin network.

These parallel networks elegantly solve three of our four problems. They allow participants to transact only in stablecoins redeemable for dollars, at regular transaction speeds, without transactions becoming public. But they don't fix the user experience problem.

For that, we need partnerships. Lots and lots of partnerships.

A new payment network has appeared

Even for someone in the space, the speed at which new partnerships are being announced is dizzying. What we need is a bridge, from the old world to the new. We need to bring both merchants and consumers onto the new network simultaneously.

We need payment processors to get onboard.

Payment processors like Square are the reason consumers can swipe their cards and merchants can accept them. They're the entry point to VisaNet and the other card networks. They also handle the networks fees on behalf of the merchants.

That is a massive opportunity. Today, payment processors pass along the 2% + $0.10 VisaNet fee to the merchants with a small markup, 0.6% in the case of Square. What if, instead, they could hook up to a network that's almost free to use and pass along half of the savings to the merchants? It's a win for the payment processor and for the merchant.

It's exactly what we're seeing. Apple Pay announced an integration with the most-used cryptocurrency wallet, Metamask. Shopify announced a partnership with Coinbase Commerce to allow any Shopify store owner to accept cryptocurrency as payment. Shopify announced another partnership with Strike to allow any business to settle in dollars transferred over the Bitcoin Lightning Network. Strike announced another partnership with point-of-sale giant NCR to enable the same "fiat settled over Bitcoin Lightning Network" system in everyday businesses like Starbucks and Walmart.

It’s just a few of the many announcements in the past couple months. The payments revolution has begun.

The Payments Revolution Has Begun

It's hard to overstate how impactful this may be. Retail payments have been dominated by just four card networks for the past 50 years. Strike and others are systematically disintermediating them at an astonishing rate.

Critically, this doesn't require a big shift in how we go about our lives. It doesn't have the adoption barriers of electric cars where we need thousands of new charging stations to replace our gas stations. You won't have to download some special app or upload your money to some new service. Instead, consumers can keep paying in dollars and businesses can keep accepting dollars the same way we do today. The only difference is that the payments are settled over open-source networks so cheap to use that they're practically free.

Passing along half the savings to merchants isn't going to last. Open-source means anyone can go build a payment processor on these crypto networks. As the usage of these new payment networks gets underway, competition will rapidly drive payment processor margins to zero. They'll need to find new ways to make money, like how Square offers short-term loans at highly competitive rates based on their detailed knowledge of businesses' daily cash flows.

The card networks won't necessarily disappear, but they will need to transform. Visa launched a crypto team years ago to get out ahead of this switch. Many of the services they sell today including fraud prevention and account balance checks will also be needed when transacting on crypto networks. The card networks have a role to play, but it will be different from the past. I doubt all will successfully make the shift.

When we look back in a decade, I doubt we'll spend much time considering this payments revolution. It'll simply have become another part of our lives, so pedestrian that we hardly give it a second thought. It's what true success looks like.

Cocktail Talk

"On the Internet, nobody knows you're a dog." Anonymity has been core to the internet, for better and for worse. It's not a new concept - even the Federalist Papers were published pseudonymously. And yet it's now being challenged. We see it in the gag-order subpoena requests to big tech companies and in the efforts to track money movement. But it's a much more nuanced conversation than most of us acknowledge day-to-day. Author Jeff Kosseff of "The United States of Anonymous" dives in. Thanks to Refind for sharing. (Protocol)

An airplane that flies with no moving parts. Orders of magnitude quieter than traditional flying machines and producing no emissions, the early prototype can comfortably fly the full 60-meter length of the testing gym. It's an awesome breakthrough. Thanks to Refind for sharing. (Designbloom)

Reforesting is no easy task, but the UK is determined to return much of the wilderness to its prior state. Plant all the same type of tree and it'll look nice but won't support the biodiversity that a traditional forest supports. But planting many species that can cohabitate is far more difficult. Different trees create habitats for different animals. They grow to different heights and die at different rates, creating canopy and ground layers that otherwise don't exist. English oak trees are among the most exciting in the reforestation effort - they can live for over one thousand years and grow to a tremendous size. (BBC)

Average hard alcohol consumption has been on a downward trend in the US for decades. Yet, and often rarely highlighted in the media, revenues and profits for the biggest brands have been steadily increasing. Any regular consumer could likely tell you that product selection and average quality have similarly been on the rise. It's no accident. Spirit producers are increasingly positioning their products as luxury goods - many are higher quality, all are higher price. The rebranding has been so successful that the growth of these new high-margin businesses has outpaced the dismal secular trend of less alcohol consumption. It's a great lesson in how averages obscure truths from one of my favorite industries. (Lindsell Train)

Your Weekly Cocktail

A summertime The Last Word variant that breaks all the rules.

Division Bell

1.0oz Del Maguey Vida Mezcal

0.75oz Aperol

0.75oz Lime Juice

0.50oz Luxardo Maraschino Liqueur

Pour everything into a mixing glass. Add ice until it comes up over the top of the liquid. Stir for 20 seconds (~50 stirs) until the outside of the glass is frosted. Strain into a coupe glass (a rocks glass will do if you don’t have one) and enjoy.

The Division Bell is a summertime staple for me. It takes our first The Last Word variant from last week - Last of the Oaxacans - two steps further. This drops Chartreuse in favor of Aperol and abandons the equal-amounts division among the four ingredients. The history helps explain its evolution. Just two years after crafting his now world-famous Oaxaca Old Fashioned we had a few weeks back, Phil Ward invented this take on yet another classic for the opening menu of Mayahuel in NYC. It was part of his effort to help mezcal go mainstream in the US. Boy did he ever succeed. By his estimates, Mayahuel sold more Mezcal in its first two years than had been sold in the whole US up and until that point. The Division Bell played a big role in the success - it's wonderfully balanced and refreshing. Each of the pieces brings something unique - the smokiness of mezcal, the sweet fruitiness of Aperol, the bitterness of lime, and the savoriness of Luxardo. I hope you enjoy it as much as I do!

Cheers,

Jared