Fat Tailed Thoughts: Crypto

Hey friends -

In this week's letter:

Blockchain part 2: into the cryptoverse

Facts, figures, and links to keep you thinking over a drink

A drink to think it over

Total read time: 10 minutes, 25 seconds.

Public & Permissionless: The Land of Crypto

This is part two of exploring the blockchain space. You can check out last week's letter where we explored private & permissioned blockchains. This week, we're diving into the wild world of public & permissionless blockchains and cryptocurrencies. All the examples that follow are ones that you can go and use right now.

A quick refresher on public & permissionless:

As the name implies, anyone can join a public blockchain and the network itself is permissionless - everyone can do everything.

Cryptocurrencies help to secure these public & permissionless blockchains. You can check out an earlier letter if a refresher on cryptocurrencies is helpful.

Cryptocurrencies aren’t the only things on public blockchains, we can also store and sell digital assets like artwork or loans. Digital assets that are created on a blockchain are called tokens. The differences between cryptocurrencies and tokens are interesting but beyond the scope of this week's discussion. For ease of use, we'll generalize and just use tokens from here on out.

Public blockchains are truly the wild west. Right now is a bit like the web in 1994 when it became free and super easy to create a website - lots of people are doing it, most of what exists will probably fizzle out, but there are really interesting diamonds among the rough. I don't claim to be able to predict winners, but we'll have fun looking at a wide variety of applications you can go and use today:

Payments - from illicit activities and pornography to mainstream uses

Video games - build, own, and trade your loot

Finance - borrow, lend, and participate in no-loss prize games

Funding - provide funding for new startups, bug fixes, and whatever else you want to sponsor

Prediction markets - bet on outcomes without a middleman

Digital Storage - store digital assets

Collectibles - buy and sell artwork, cryptokitties, and other unique digital assets

Those keen-eyed among you may notice that I did not include two prominent domains: the many emerging variations of digital money and decentralized autonomous organizations. Both are too complex to do justice here as part of this exploration. We'll tackle them in future weeks.

Standard disclosure as some of this will meander in and around regulated financial instruments: none of my writing should be taken as investment advice, many of these examples are likely to fail, some may be frauds, and be prepared to lose your shirt (or pants or what is formally called your entire principal investment) if you choose to put money into them.

Payments

Payments are the original public blockchain use case. The bitcoin white paper was titled "Bitcoin: A Peer-to-Peer Electronic Cash System" and the first now-infamous high profile use came from someone purchasing two Papa John's pizzas for 10,000 bitcoin. Payments emerged as the first use case in large part because there simply is no such thing as a digital dollar. When you "send money" digitally, you're just sending messages between financial institutions to update the amounts in accounts held on behalf of the sender and receiver.

Cash is different than how “digital” payments work today. Cash is a bearer asset, meaning that whoever has physical possession of the asset owns it. We can use a public blockchain to record and directly transfer ownership of tokens, a digital bearer asset, to one another and treat those tokens as payments. Individuals and businesses cut off from the financial sector have started using tokens-as-payments to conduct transactions where cash isn't feasible.

Illicit activities is the largest domain cut off from the traditional financial system. Silk Road, an online black market active from 2011-2014, helped drive the early adoption of bitcoin as a payment mechanism. Bitcoin's use for similar illicit activities continues to decline and it has only ever been a small piece of the over $2.5 trillion a year of global illicit financial flows. As Silk Road aptly demonstrated when it was shut down in 2014 - public ledgers that everyone can observe aren't great for illegal financing.

Pornography, while legal, remains taboo and has similarly been intermittently cut off from the financial system. SpankChain launched in 2017 as a first meaningful attempt to provide an alternate means of payment. PornHub, the 13th most visited website in the US, began exclusively accepting tokens as payment in late 2020 after Visa and Mastercard cut off the site from accepting credit cards.

Like Ripple highlighted last week, Stellar is helping facilitate the over $500B a year of remittances as families abroad send monies to their families back home. With over 1.7 billion people lacking access to banking and banks charging $50+ for international wires on top of often ludicrous exchange rates for those that do have access, Stellar is facilitating an incredibly important yet underserved need.

Video Games

Video games are now a $180 billion a year industry in North America alone, greater than movies and sports combined. Players invest hundreds of hours playing games to level up and earn in-game rewards. Other in-game rewards can be purchased and entire games are built under a “freemium” model where the game itself is free but rewards cost money.

In-game rewards, like costumes and weapons, are starting to be represented as tokens on public blockchains. Decentraland allows players not only to create their own wearables and artwork, but also to own digital plots of land. The blockchain guarantees that only a finite amount of land will ever exist in the game, giving it some amount of value as a scarce asset. These digital assets are represented as tokens and can be bought and sold in a marketplace with payment denominated yet another token, the Decentraland MANA.

To date, Decentraland, Blankos, and the other video game blockchain startups have focused most of their efforts on creating tokens. While the games themselves are remain rudimentary, the promise of what they're developing is game-changing for the industry.

Because the digitals assets that the players create are tokens on a public blockchain, players can bring their assets with them to other video games. There's no limit to these cross-game universes. The blockchains are public and the tokens are built on standards available to everyone. Any game developer can choose to integrate with the public blockchains and support the standards to allow players to port their assets from one universe to another. This is revolutionary for companies like Disney that own diverse brands including Marvel superheroes and ESPN sports. Disney and their peers can put the fans in the driver's seat, enabling them to create their own crossover universes that meld elements from the many brands into their own personalized experience.

Finance

You can be sure that if an asset can be bought and sold, somebody will create financial markets around it. Tokens are no different. Finance around tokens is known as DeFi - decentralized finance.

There's over $53 billion locked up in various DeFi applications. Because they run on public blockchains, they replace middlemen with code. Want to borrow against your token holdings or lend them out? You can store your tokens in your Argent wallet and lend them out through Compound. The code itself requires the borrower to put up collateral against the loan. If the borrower fails to pay the requisite interest, you as the lender automatically collect the collateral.

Do you want to lend your tokens but don't want to deal with the hassle? You can hook your bank account up to Donut and they'll do everything for you. They'll convert your cash to tokens, then lend out your tokens and send you a 4% yield.

Maybe you want to earn an even higher yield? If you manage your own tokens you can lend them out through Yearn. The service will scour the many lending opportunities to look for the highest yield on your behalf. It won't just do it at the start of the loan, it'll continuously and programmatically move your tokens to wherever it can get the highest yield.

If instead, you want to participate in something that feels like gambling you can use PoolTogether to join no-loss prize games. Participants can put their tokens in prize pools and the PoolTogether code will lend out all of the tokens. At the end of a pre-determined prize period, the PoolTogether code picks a winner who receives all of the interest earned and all participants receive their initial investment back.

There are many, many more DeFi projects already live that you can explore here.

Funding

Near adjacent to traditional finance is funding. Public blockchains have unleashed fascinating ways to fund new initiatives, well beyond the standard models.

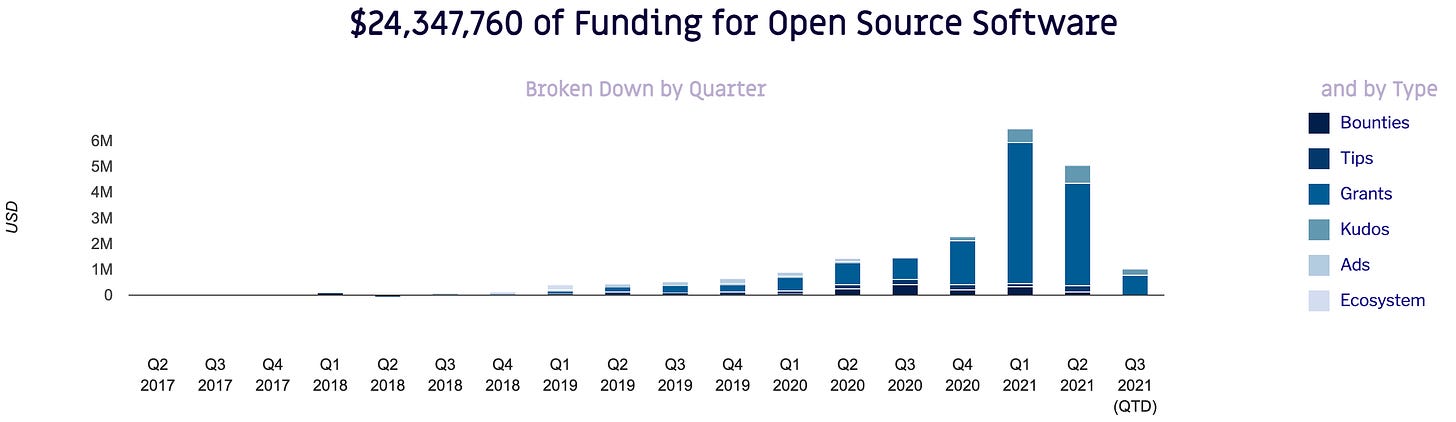

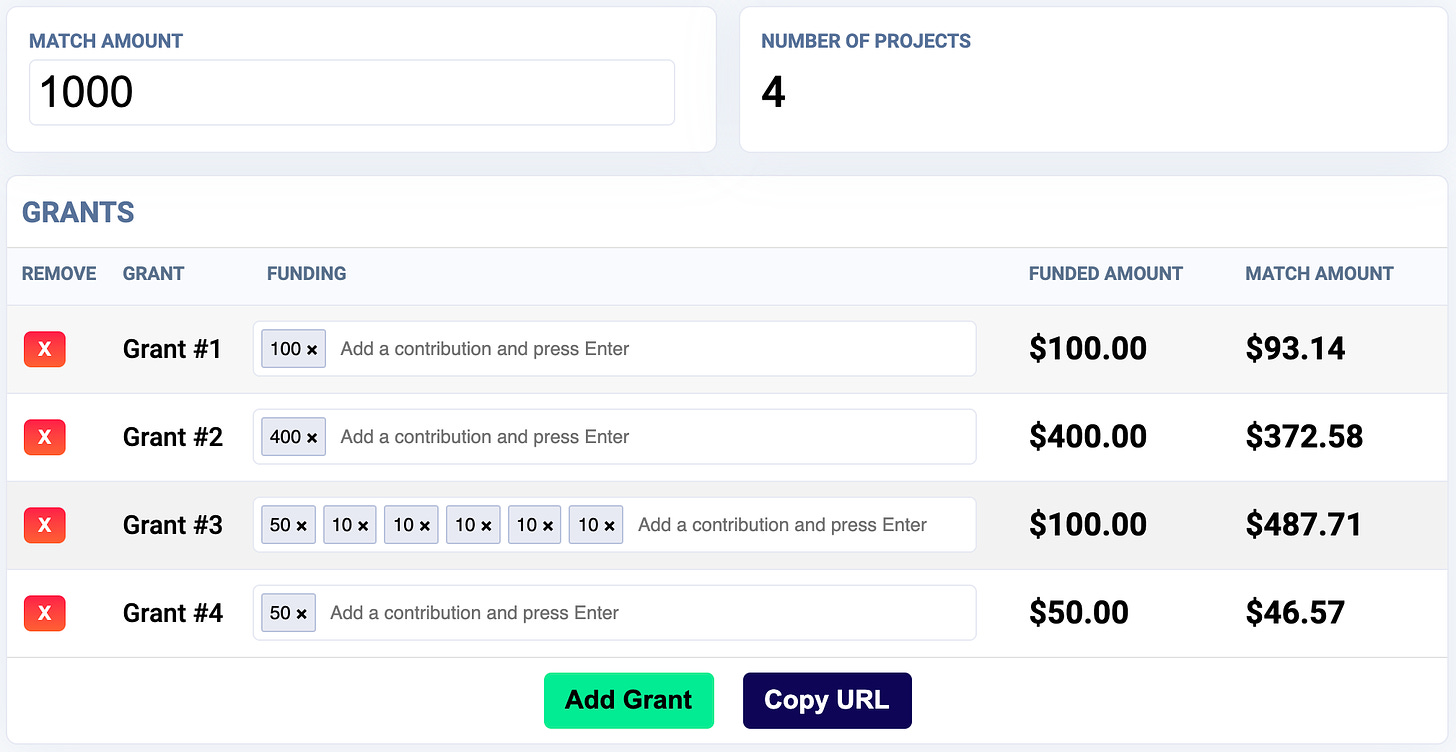

Gitcoin has facilitated over $24 million for open source projects and HackerLink regularly facilitates bounty programs where anyone can crowdsource solutions that pay out to the solution providers. Both use public blockchains to facilitate quadratic funding to allocate rewards.

Quadratic funding works by crowdsourcing investments or donations alongside a matching pool of capital. The crowdsourced funders allocate their dollars towards projects they want to see funded in the first round of voting. The quadratic funding algorithm, running on blockchain, then allocates the matching capital by overweighting the number of votes and underweighting the amount of capital they've already received. This method ensures that projects that receive the most unique votes receive the most matching funds, thus enhancing the impact of individual voters and reducing the impact of major individual funders.

You can go deeper on quadratic funding here, including playing around with a calculator to see how it works. It’s early days for quadratic funding but it is a promising avenue for democratically funding public goods, including through public-private partnerships.

Prediction Markets

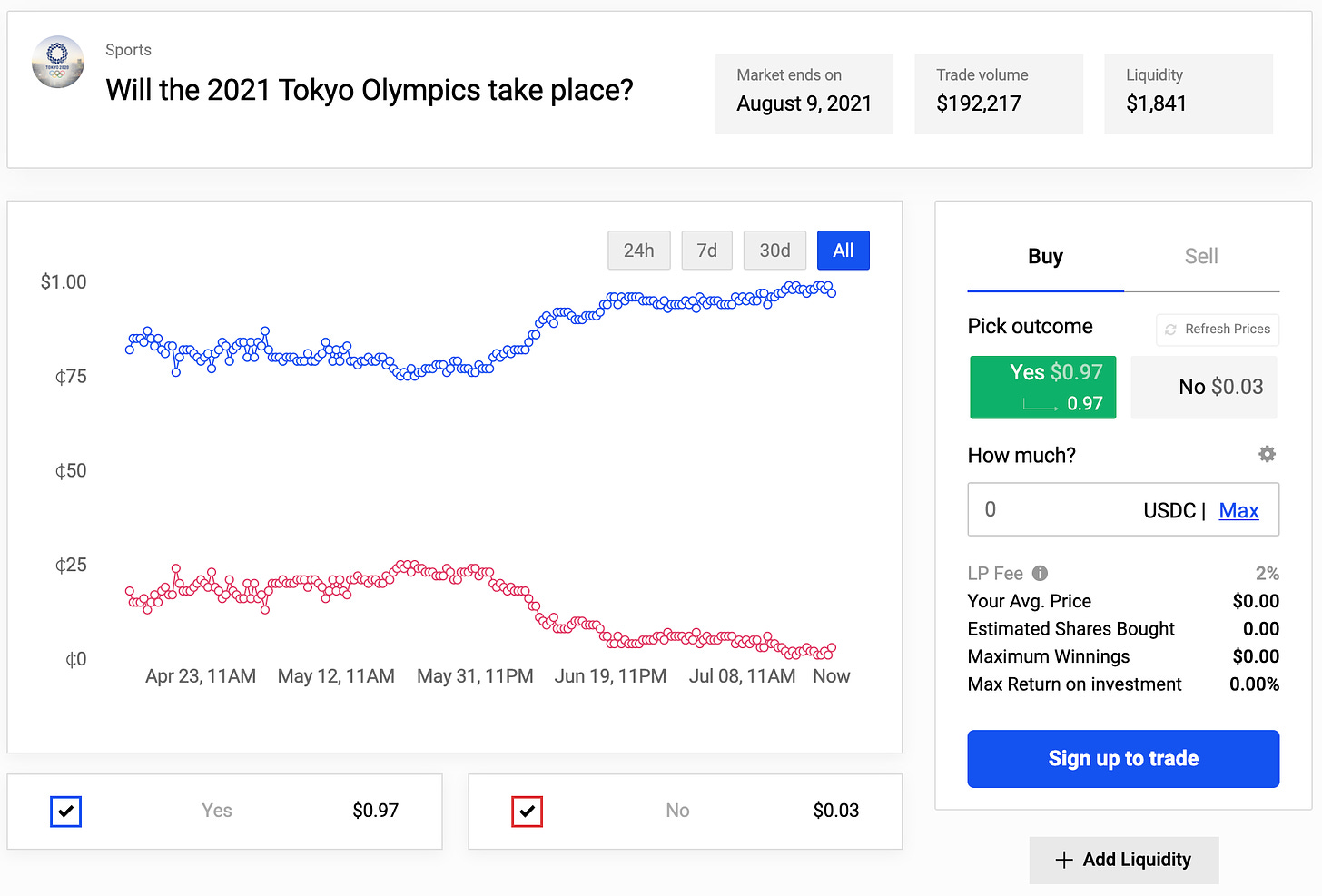

Let's call this what it actually is - betting. If you look hard enough, there's someone somewhere creating a betting pool on just about anything outcome you can think of. Sports are among the most popular and, while reliable market size numbers are difficult to find given how much betting takes place outside of sanctioned arenas, the market appears to be more than $30 billion per year in the US alone.

But why put up with a 4.5%+ vigorish on your bets? And why limit yourself to what the bookies want to create markets in?

With Polymarket you can bet on whether Donald Trump will be president on July 31st, if Britney Spears' father will be removed from her conservatorship by October 1st, or if Bucks winning the NBA finals. The cost of a vote fluctuates based on how many people are voting for or against the event and payoffs are correlated to the vote cost. If you want to participate but don't have a strong opinion on the outcome, you can instead be a liquidity provider to the betting pool. Liquidity providers automatically take the opposite sides of trades - if you purchase a "yes" vote, they automatically purchase a "no" vote. Liquidity providers get paid fees for providing the service and typically breakeven on the betting itself as long as markets don't move too much.

Some blockchain-based betting markets like Omen have even started using Kleros to adjudicate bets. Kleros is a dispute resolution application that uses blockchain to escrow disputed funds and crowdsource resolutions to arrive at fair outcomes.

Digital Storage

We've generated and stored a truly mind-boggling amount of digital data in recent history. Growing at over 61% per year, total global data storage is now 59 zettabytes. Each zettabyte is a trillion gigabytes or 10^21 bytes. To attempt to put this in perspective, imagine a dime. Now try to imagine a tower of 10^21 dimes. If you've pictured this correctly your tower will be 1,275 light-years tall, or 300 times the distance to the nearest star system. That's not really a number that makes sense.

Although we seem to be rather good at storing all this data, public blockchains are serving much-needed shortcomings. IPFS (InterPlanetary File System) and the related FileCoin created a decentralized storage network. Web pages are notoriously short-lived, with over 50% of sources linked in Supreme Court court decisions no longer working. Rather than store a web page on a single server, IPFS replicates web page files to many locations ensuring that it is always available. If you want your web page stored on IPFS, you pay storage providers on the network in FileCoin tokens. Do you have excess storage capacity, maybe an old hard drive laying around? You can be a storage provider on IPFS and earn FileCoin!

Censorship-resistance is a key feature of IPFS's design. In 2017, the Turkish government ordered a state ban of Wikipedia because Recep Tayyip Erdogan declared it a threat to national security. Hacktivists backed up Turkish Wikipedia to IPFS, ensuring that there were many copies stored all over the world and effectively un-censorable.

Arweave is tackling a parallel problem - permanent storage. You pay an upfront fee in Arweave tokens to permanently store data. Your payment goes into a shared pool that is paid out over time to storage providers. By creating a long-term incentive to store data, the network establishes a store-it-and-forget-it model that doesn't depend on any individual company continuing to store your data.

Web pages are just one example. Anything digital can be stored using these services.

Collectibles

No discussion of tokens is complete without collectibles. Non-Fungible Tokens, or NFTs, were all the rage just a few months ago and form the basis for collectibles. At the core of a collectible's value is that has a limited supply and an NFT is a mechanism to prove that limited supply.

Cryptokitties were the original NFT collectibles and made their splash in 2017. No two cryptokitties are exactly alike and when you purchase the NFT, you own that unique cryptokittie.

This presaged a 2021 collectibles NFT boom. The same company behind cryptokitties led the 2021 charge with NBA Top Shots where you can purchase tokens that encode unique ownership of LeBron James dunking and other basketball highlights. Sotheby's got in on the action and facilitated $17M in artwork sales, all stored as NFTs.

The crypto multiverse

This Cambrian explosion of public blockchain projects is in large part due to the composability of the various projects. All of this is built on open, often interoperable technology that anyone can use - tokens issued in one place can be used in another project, and even entire applications can be reused.

We've discussed each of these public blockchain uses as standalone ideas but in reality, many are very much interlinked. Wearables in video games are in fact collectibles issued as NFTs. NFTFi is a lending platform that allows you to borrow against your NFTs. Payments are pervasive with bitcoin and ether as the primary payment tokens used to purchase blockchain-based services. The list goes on.

The public blockchain space is still in its infancy but growing at an extraordinary clip with new projects coming online almost daily. Keep an eye on it and you'll start to see these make it into the mainstream.

Cocktail Talk

NSO Group's surveillance software was used to monitor over 50,000 people around the world. Among those hacked - France's president, Pakistan's prime minister, and 12 other heads of state.

Apple collaborated with Amazon's request to take down an iOS app that detects fake Amazon reviews. Amazon claimed IP infringement, which while potentially true is an often-used excuse for meritless takedown requests.

The US vaccination rate is continuing to slow, but the slowdown is not equally distributed. Vaccination rates in counties that voted for Trump in the recent presidential election are following further and further behind those that did not.

Peloton is the best paying music streaming service. While much smaller market share, Peloton pays out 10x more per stream than on Spotify. Or maybe not. Check out the article for a deep dive into the complex web of payments for streaming services.

Your Weekly Cocktail

A true classic this week. Perfect for all weather, but especially those hot muggy days.

Dark ‘n’ Stormy

2.0 oz Goslings Black Seal Rum

1.0 oz Barrow’s Intense Ginger Liqueur

0.5 oz Lime Juice

4.0 oz Seltzer

Pour everything into a collins glass and fill to the brim with ice. Add a lime wedge to garnish and enjoy.

A Dark ‘n’ Stormy is among my all time favorite drinks. A drink made famous by Bermuda, this one is a staple of sailing culture. I apologize to those purists who may be offended at my swapping Barrow’s for the traditional Barritt’s Ginger Beer, but I stand by my choices. Barrow’s is produced small batch in Brooklyn and is far and away the most gingery drink I’ve ever tasted. It both ups the spiciness of the drink and tones down the sweetness that comes with ginger beer. Next time you’re heading to the beach, premix a couple of these to bring with you. You won’t regret it.

Cheers,

Jared