Fat Tailed Thoughts: Watches, Supreme, & Signaling

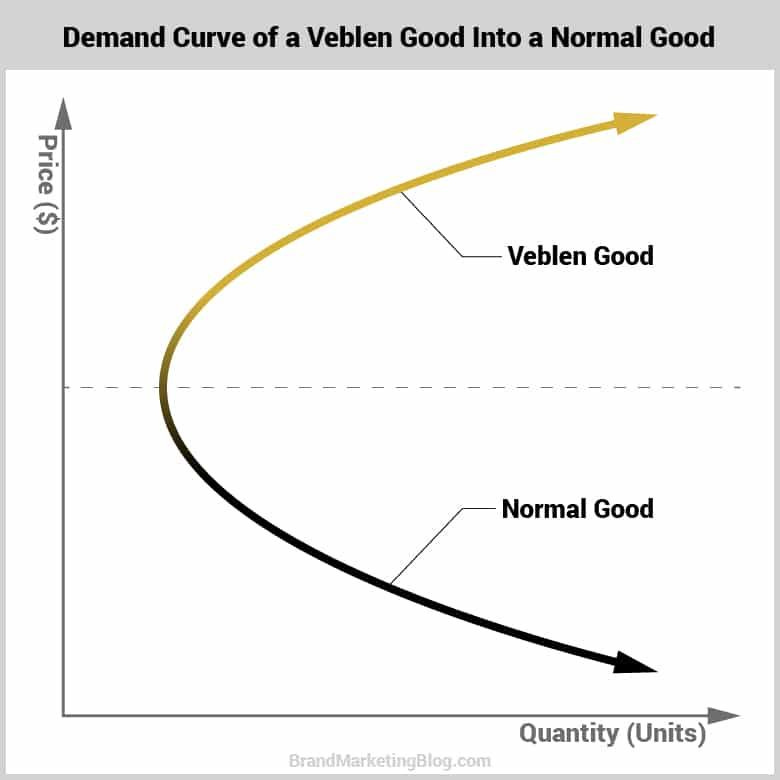

When price increases, demand for most goods falls. But not all. There's a weird class of goods where demand rises with price. These "Veblen Goods" lead to businesses unlike any other.

Hey friends -

Inflation continues to be a hot topic. The Federal Reserve has its hands full trying to tame price increases given the current macroeconomic climate.

Inflation usually means we consume less. It's basic supply and demand - as price goes up, demand goes down. Maybe we don't consume less but instead substitute, like purchasing cheaper chicken instead of expensive beef.

But there's a whole class of goods for which normal supply-demand dynamics don't apply. For these goods, demand increases as price increases. High-end handbags, watches, cars, and even some stocks. Welcome to the world of Veblen Goods.

In this week's letter:

When demand increases with price: how to build a Veblen brand, watches & shoes, and when products become investments

Da Vinci's helicopter (finally) takes flight, how we got cheap renewable energy, and more cocktail talk

A margarita for when its 70 degrees in March, the Marga-wish-a

Total read time: 9 minutes, 54 seconds.

Price Up, Demand Up!

"Humans are a social creature and status-seeking by nature."

- Eugenie Wei on Invest Like the Best

Status-seeking social creatures. It's the beating heart of Veblen goods. How do you signal?

We're outside the realm of traditional economics which assumes that as price decreases, demand goes up. We're into a world where as price increases, demand goes up. The ever-rational Homo economicus wouldn't purchase these goods but we will.

The "price up, demand up" dynamics don't hold across the entire price range. There's an inflection point for Veblen goods. Price high, they're useful for signaling. Price low, they're not as useful for signaling. But price low enough and you're back to a normal good where demand will increase as price decreases.

It's a wild dynamic that's not just binary. Goods can exhibit a Veblen "effect." How you build a brand or sell a product around such dynamics is fundamentally different. It all starts with signaling.

Who are you signaling?

We're all human (unless we're Zuckerberg). We just "get" signaling1 because we use them to make purchasing decisions every day. Brands co-opt our receptiveness to make money.

Signaling is about others, not the buyer. Expensive goods can signal that you're rich, like with diamond rings. Exclusive and expensive goods can signal that you're in the know, like with designer clothes. Supreme took signaling to an extreme with products such as ordinary t-shirts that cost $300+ because they feature the Supreme logo.

Featuring celebrities with your product is a classic way to signal. Restricting quantity is another. It's not just that the product's expensive - it's that I have it and you can't. But limiting quantity isn't enough. Other potential buyers have to know that the quantity is limited. Brands will go to extreme lengths to publish the limited quantity, such as how Nike organizes pre-announced "drops" designed to sell out as quickly as possible.

There's always the temptation for brands to commit to quantity restrictions then re-neg in the future. Car manufacturers including Jaguar are prolific with their re-releases. There's an unknown limit to just how much new quantity they can re-release before reaching the "not useful for signaling" inflection point. While brands like Jaguar experiment, the value of the product for existing owners will continue to decline. One promise of NFTs is that they avoid such shenanigans by programmatically limiting the quantity of a given NFT that can ever exist.

Quantity restrictions have to be closely managed. Fraud is one challenge as new inauthentic supply is introduced to the market. The art world, including NFTs, regularly struggles against artwork fraudulently attributed to well-known artists. But quantity can also surge when authentic supply unexpectedly floods the market. A few years ago, China cracked down on corruption including the ownership of luxury goods that had been used as bribes. Thousands of Cartier and Montblanc watches flooded the market at discount prices. Parent company Richemont moved quickly to remedy the situation:

The Swiss watchmaker Richemont has destroyed nearly €500m (£437m) of its designer timepieces over the past two years to avoid them being sold at knockdown prices... It was worried that unsold stock would end up being discounted in the so-called “grey market” of unauthorized resellers, damaging the image and pricing power of its brands.

The toolkit's simple - price and quantity - but it leads to a fascinating variety of businesses.

Redefining Luxury Goods

Many high-priced luxury goods are not of higher quality. Rather, they're carefully curated brands that have co-opted our need to signal to create Veblen goods.

I'd inevitably offend some readers by picking on most goods. For almost any given product, there are arguments about how it's differentiated in some small way that justifies why demand increases with price. The pinstripes on the Rolls Royce are hand-painted by Mark Court or that Chanel handbag is made with the finest lambskin. Sure.

Thankfully, there are a couple of products where the only thing that changes is the brand and the price. Nowhere is this dynamic more remarkable than in the world of watches.

The Wonderful World of Watches

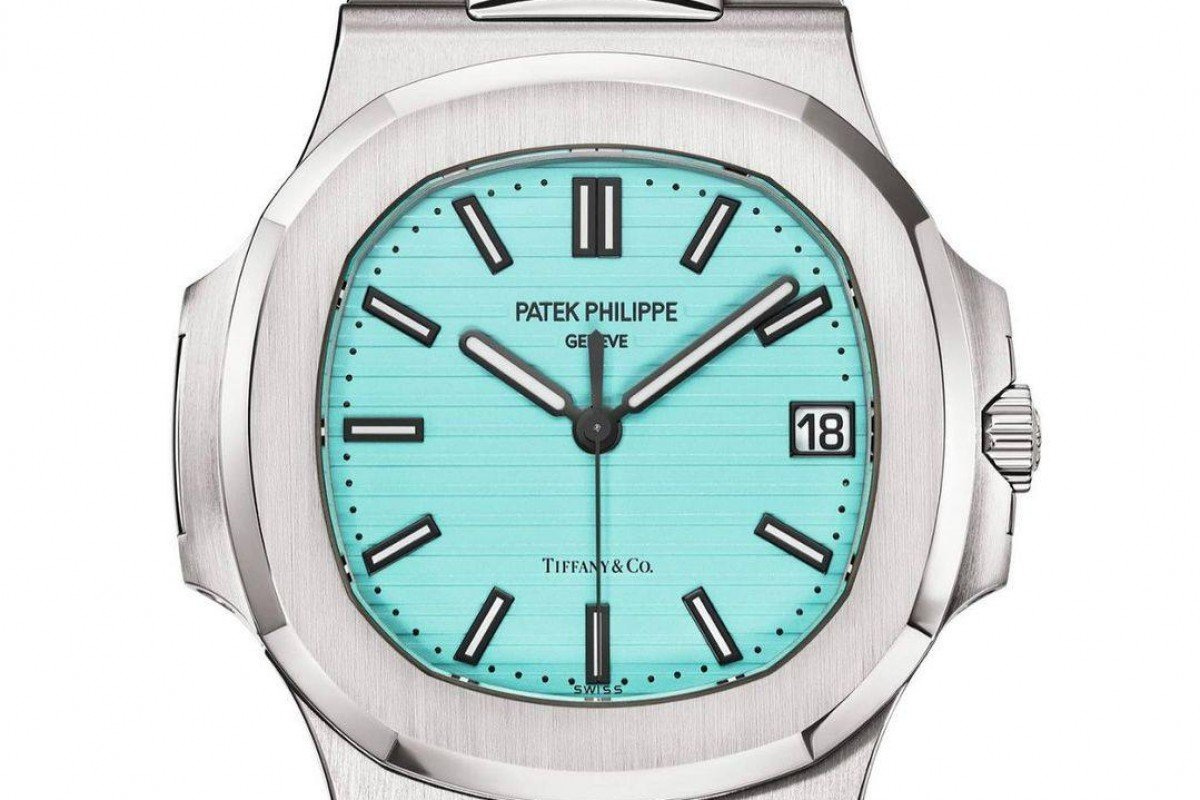

The Patek Philippe Nautilus Ref 5711/1A with navy blue dial in stainless steel.

The retail price is around $30,000. But that doesn't mean much. Even before it was retired, the waitlist to buy one from a store was 8+ years assuming you had an in. It now retails for over $100,000 in the secondary market.

Unless you're a watch person like my podcast co-host Steven Dickens, it's difficult to imagine why anyone would pay that much for a watch. It's even more difficult to imagine why someone would pay even more for a Tiffany branded version, but such a version sold at auction in 2019 for $125,000.

But that's just where the fun begins.

This is fundamentally that same watch again but as a special Tiffany release. Not only do you get the Tiffany brand, but you get a different blue dial and an inscription on the back. It retailed for $52,635 and just 170 were produced. 169 were sold to lucky individuals by invitation only. Just one was sent to auction. The winning bid?

$6,503,500.

You can't make this stuff up.

This isn't the wild, uncontrollable mania of crowds that led to the tulip bubble or dot com boom. This carefully curated mania was executed brilliantly over decades.

Patek Philippe was founded in 1839. It produces only 60,000 watches a year, a pittance compared to the roughly 1 million Rolex produced annually. Production numbers are mostly a guess though. The company is privately owned, doesn't release production numbers or financials.

The Tiffany relationship is also old. They've been an official Patek retailer since 1859. From time to time, Tiffany stamps its name on Patek watches. They're the only retailer still allowed to do so.

The watch in question is part of the Nautilus sports line. Retail access to the entire line is limited - generally by invitation only - the Ref. 5711 even more so as demand has increased.

Limited supply, limited access to that supply, and 170-year-old brands. That's a good start to a Veblen good. But it can be helped by celebrities and social media.

He likely purchased both of those watches. Giving them away - even to Jay-Z - could harm the brand. But he knows better than anyone that those watches become more valuable the moment he puts them on. It's a smart purchase.

Social media accelerates the power of celebrities. watchanish has 1.7 million Instagram followers and it's just pictures of watches on his wrist. Websites and apps like Fratello and Watchville are content-driven social experiences around watches. Curated news leads to analysis and conversation among watch enthusiasts. Purchasing an expensive Patek doesn't seem so crazy when you can signal to your friends. You're just buying status.

Every time Jay-Z appears with a Patek Philippe, it gets shared thousands of times within these communities. Jay-Z enthusiasts who aren't yet watch people join the community to better understand that part of Jay-Z. The community grows. These enthusiasts can now justify purchasing a Patek because they get status in two communities - watch people and Jay-Z people. Demand grows further.

Patek Philippe has a tremendously powerful flywheel. Exclusivity via limited quantity and a high price, accelerated by the careful curation of clientele and online communities. What they're selling ultimately isn't watches, it's status.

Veblen Investments?

The world of Veblen goods has exploded.

It's not a new concept. Much of art, especially that by bluechip artists sold at auction, exhibits Veblen effects. But the market has expanded in recent years to NFTs, stocks, sneakers, Supreme branded everything, handbags, and more. We'll see even more soon as luxury brands like Balenciaga create digital fashion for the "metaverse."

It's all the same playbook. Brands carefully curate initial demand for high-priced, limited supply goods. Prices increase, demand increases, but supply remains restricted. The inevitable happens.

Secondary markets.

In the early days of secondary markets for Veblen goods, status seekers drive trading volume. But that model doesn't scale well. Status seekers buy to own, not to sell. You need traders.

Traders aren't really a part of the status-seeking community. They're a new type of demand that's in it to buy low and sell high. They're middlemen looking to profit. Quickly they become the majority of trading volumes.

StockX lets you trade sneakers, Supreme branded everything, and other pop culture goods. Hodinkee facilitates a market for watches and Rebag one for bags. The list goes on.

These Veblen goods are starting to be called investments. The prices have gone up reliably for a time - there's growing ownership demand from new status seekers coupled with growing profits demand from traders. You can now easily cash out. Investment seems to be a proxy for "price goes up" and "easy to sell."

But prices don't go up forever. It may be that traders find greener fields elsewhere or that a brand floods the market with supply. Who knows, but the dynamics as prices decline are going to test the concept of these goods as investments.

Traders will be the first to exit - better to dump inventory and get out at a small loss than wait and take a big one. Lower trading volumes and lower revenues will force secondary markets to consolidate to survive.

The declining prices will hit the status-seeking communities differently. That person who bought a Patek because Jay-Z wears one probably won't stick around when Jay-Z stops showing it off. That doesn't mean they necessarily sell. It means that they stop participating in the community, they stop using the watch to signal status. It leaves the owner in a very weird place - they bought status but they're left with a watch. That's not nearly as valuable. Price falls further.

The backstop is the community of true believers, the ones for whom the watch remains a Veblen good even at low prices. They were the first to own the watch, the first community members, and they'll be the last to leave.

If that core community is big enough, the demand robust enough in the face of a price collapse, and the brand doesn't muck it up, then the saga can continue. Demand can rebound and the cycle of increased price, increased demand can begin anew. The hope is that it attracts new true believers that grow the core community and make it that much more robust.

But if the community falters, if the investment hypothesis collapses... well, at least you'll know the time.

Cocktail Talk

Crypto, coming to a bank near you. Offering cryptocurrencies to banking clients requires novel operations, technologies, and risk management. It starts with custody - actually holding the crypto. Traditional custodians including BNY Mellon and State Street want to support their clients' crypto demands but don't have the toolkit to do so. Startups like Anchorage, Fireblocks, and NYDIG can custody but don't have multi-decade relationships with major asset managers. The two worlds are coming together. (Cointelegraph)

It took 400 years, but da Vinci's helicopter finally took flight. A group of engineers manufactured a drone-sized prototype of da Vinci's helicopter. With the help of modern materials and some engineering tweaks, it took flight. Scroll down to the bottom for a short video of it in action. (Big Think)

Cheap renewal energy was a pipe dream just a few years ago and now it's not only plausible but actively being pursued. It's a great example of an exponential trend, or rather, multiple overlapping exponential trends. Consider the relationship between solar energy and price. It took a decade to increase install capacity from 1 megawatt to 100 megawatts. Over that time the price fell 90%. Over the next 10 years, the price only fell by 50%, but we increased capacity by 10x. The same happened again the following decade and again the decade after. We humans often mistake exponential trends as linear and get surprised when we discover they're not. Exponential trends like this change the world. (Our World In Data)

Half a mile beneath the Arctic, well away from the sun, there's a thriving centuries-old garden of sponges. We don't give much thought to the fungi that live in the soil beneath our feet, but without their decomposing powers, the earth's surface would quickly be overwhelmed. We give even less thought to the decomposers in the deep sea or the role they play in recycling dead organic matter. The cycle of life, death, decomposition, and eventual rebirth as organic matter in new living organisms often takes millions of years. These sponges, slowly decomposing the fossilized remains of a long-extinct ecosystem are an extraordinary reminder of just how remarkable our planet is. (Vice)

Your Weekly Cocktail

Many letters later and we finally have our first margarita!

Marga-wish-a

2.0oz Blanco Tequila

1.0oz Cointreau

1.0oz Lime Juice

0.5oz Ginger Simple Syrup

1tsp Tamarind Paste

Add everything to a shaker. Fill with ice until comes up over the top of the liquid. Shake vigorously until the outside of the shaker is frosty, ~20 seconds. Add ice to a tumbler. Strain cocktail into the tumbler and enjoy.

We had about ten minutes of 70-degree weather here in New York before the rain came. Just enough time to make a margarita while wishing for spring. On their own, the spice of ginger and sour tamarind add interesting notes to the classic cocktail. Together, they create something wonderfully unexpected. The tamarind has sweet notes that mellow out the rougher edges of the ginger - you can ramp up the ginger without the heat scorching your tastebuds. Despite the strong flavors, they don't overwhelm the drink - the citrus keeps everything in check. It's a beautifully balanced drink, enjoyable even as the rains roll in.

Cheers,

Jared

These characteristics are not technically all "Veblen effects." Economists break them out into the "snob effect" among others. They’re cousins if not siblings. I'll leave the delineation to the academics.

very interesting

very interesting