Fintech & Finance: Real-Time Payments

The Fed's made a mess of a rapidly growing private sector real-time payments network, but perhaps there's a silver lining.

Hey friends -

We're back! After 60 unbroken weeks of letters, life got the better of me. But - we're back!

Lots of new developments are in store for the upcoming weeks. Developments in payments and stablecoins are heating up, cracks in financing markets are expanding into canyons, and crypto markets are attempting to build through the longest winter in memory.

Through it all - founders and startups are continuing to build.

This week we're looking at real-time payments, a typically (and ironically) slow-moving arena. Unusually, it's heating up. In an unexpected move, the Federal Reserve is setting itself on a path to compete with nascent private sector initiatives. While the announcements threaten to upend the burgeoning industry, there may in fact be room for both.

p.s. I'll be at Money20/20 in Las Vegas later this month. Drop me a note if you'll be there - the first drink's on me 🥃 🍺 ☕️.

In this week's letter:

Where have I been?

Real-time payments: the Fed makes a mess of a rapidly growing private sector solution, but perhaps there's a silver lining

Predatory lending, the passing of a titan of American history literature, and more cocktail talk

The Rumpernickel, a wintertime drink for the not-quite-cold-enough fall days

Total read time: 12 minutes, 48 seconds.

Where Have I Been?

Firstly - an apology. The intent was not to disappear unannounced for two months.

Second - an explanation. Where on earth have I been?

High highs and low lows.

I recently welcomed a new addition to the family with the birth of my first child (#girldad)! Wife and daughter are both doing wonderfully. It's a wonderfully exciting - albeit exhausting - new adventure.

I joined Vouch - commercial insurance for startups - to build the web3 practice. We're live and first-to-market, actively underwriting web3 startups with comprehensive insurance products specifically designed to address the unique needs of web3 companies. If you're building a crypto or crypto-adjacent startup, I'd love to help.

My brother's company1 - Amylyx - secured FDA and Health Canada approval for their flagship drug for the treatment of adults with ALS in the US and Canada respectively. It's an enormous win for the company and for the many thousands that suffer from ALS.

In less happy news, a family member passed away and another was diagnosed with cancer. The latter is doing very well given the circumstances - treatment has progressed extremely well and we (and the physicians) are optimistic about a complete remission. Against the backdrop of new life and celebrations, it's a reminder of the precariousness of life and the limited time we have together.

It's been a wild couple of months. I'm glad to be back.

Onto our regularly scheduled letter.

Aren't Most Payments Real-Time?

No. Real-time means a transaction is processed immediately upon receipt. Most payments have delays often measured in days.

Cash can be real-time. When you buy a $1.50 hotdog at Costco and hand the cashier cash, that's real-time.

Almost every other transaction isn't.

Credit card transactions run along networks operated by Visa, Mastercard, and other card networks. What appears real-time to you and me is actually multi-day settlement under the covers. Payment is authorized almost immediately, but funds aren't transferred until days later.

ACH transactions (Automated Clearing House) batch payment instructions three times per day, but the actual settlement of funds takes another two days after submission. For an additional fee, you can make it same-day.

Wires are typically batched a couple of times a day by your bank - they combine all of the wire instructions in the past few hours and submit them en masse to either Federal Reserve operated Fedwire or privately operated CHIPS. They're both real-time but with significant limitations.

Just a handful of banks actually have access - 40 in the case of CHIPS. Everyone else goes through one of the participating banks, none of whom are real-time themselves. Operating hours are limited to working hours and only from Monday to Friday. Neither are real-time in any practical sense.

Why does real-time matter?

For most of our day-to-day payment needs as individuals, delays don't matter. Intermediaries like credit cards and PayPal give us a "good-enough" facade of real-time when time matters.

The payment recipient is making a zero-interest uncollateralized loan to the payment sender for however long it takes the payment to arrive. Or an intermediary uses its balance sheet to make the sender and receiver whole and shoulders any temporary risk.

That works for small dollar transactions. It breaks down for large dollar transactions. For a business that needs to move $25 million between subsidiaries to make payroll or $50 billion to settle outstanding stock trades, days and even minutes matter in the transfer of funds.

The cost of delays is threefold:

Counterparty risk. Anything can happen between the moments a payment is sent and received. When Lehman Brothers went bankrupt, over $500 billion in outstanding trades had yet to settle. Immediately exposes you to the least counterparty risk.

Liquidity risk. If you're a business like Walmart, you have $56 billion tied up in inventory that can't be spent on other activities like payroll. That means you need excess cash - beyond what's tied up in inventory - to operate your business. The same can happen with money. Money you're waiting on because a payment authorization has been made but the actual funds haven't arrived is money you can't spend. If you have to wait two days for a $10 million payment to arrive and you need to make payroll tomorrow, you need millions in excess cash.

Lost income. The overnight repo rate is currently 3%. That means market participants can borrow cash - collateralized by US treasury bonds - at a daily rate of $82 per $1 million loan. That might not sound like much, but it tends to add up if you lend hundreds of millions a night. If you're still waiting on payments to arrive, that's money you can't lend.

Every day, Fedwire and CHIPS together process over 1 million transactions totaling over $6 trillion in value. That's a lot of value at risk because of payment delays.

Real-time payments are what they sound like - instant. They eliminate these unnecessary frictions.

Real-Time Payments

The first real-time payment service in the US went live in 2017, conveniently called RTP (short for Real-Time Payments). Available 24x7x365.

RTP is operated by The Clearing House, a private company owned by the major commercial banks including Bank of America, BNY Mellon, Citi, and JP Morgan. It's the same entity that operates CHIPS and ACH.

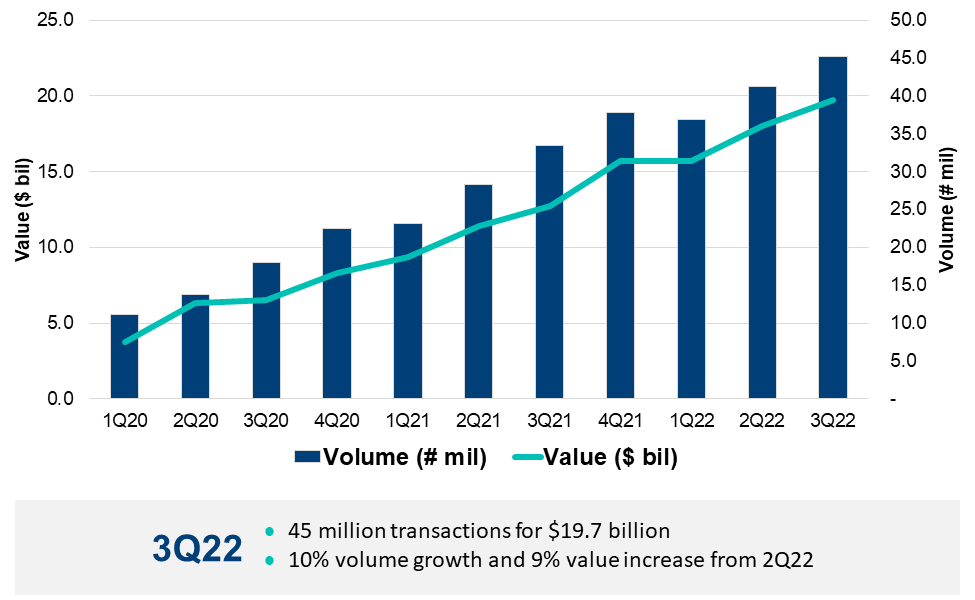

RTP usage is a remarkable story. If you were just to analyze dollar values, it's entirely unimpressive. Five years in, the network is processing just $220 million per day - a far cry from the $6 trillion processed by Fedwire and Chips. But if you look at the transaction volume, it's a different story entirely.

RTP is processing half a million transactions every day. It's already half the volume of the well-established payment incumbents!

What's emerged is an entirely different use case. The average transaction size on Fedwire and CHIPS is between $3-4 million. Contrast that with the scant $438 average transaction on RTP.

We've never seen anything like this in the US before. The network is designed specifically to make inexpensive real-time payments available to every financial institution regardless of institution size, transaction volume, or transaction value. The commitment shows up again in the pricing schedule:

No volume discounts

No volume commitments

No monthly minimums

Per-transaction fees that range from $0.01 - $0.10

Looking solely at usage, it's been an unmitigated success. But that's not the whole story.

The long tail of community banks

The US has a lot of banks. Almost 5,000. And then another 5,000 credit unions for good measure.

For perspective, Europe has about twice the population of the US and the same number of banks. Japan services its 125 million citizens - roughly a third of the US - with just 200 banks. Canada has only 35 banks for its 38 million citizens.

Any way you cut it, the US is an outlier. We've got a lot of banks. That can cause challenges when you're rolling out a new payment system like RTP.

By The Clearing House's measurement, RTP is available to 60% of the US banked population.2 But that doesn't mean it's available to 60% of US banks.

In fact, only 274 banks and credit unions are participants. A mere 3% of the total. There's a long way to go before RTP is generally accessible.

The question is why.

Technology is just 5% of the problem

The immediate answer is that technology availability is only 5% of the problem. The other 95% is the hard part.

The vast majority of banks use technology vendors like FIS, Fiserv, and Jack Henry to connect to payment systems like RTP. That means there's a natural delay in adoption. First, the technology vendor has to update its systems. Then they have to have the implementation teams available to help banking customers make the necessary updates. Usually, the implementation teams are capacity constrained so there's yet another delay as consultants like KPMG, E&Y, and PwC train their teams.

But even that's not even the hard part.

It's people and processes. Banks aren't set up to process payments in real-time, 24x7x365. Teams have to be retrained, overnight customer support has to be hired and trained, and new process documents have to be written and implemented. All of these new activities come with new operating risks - that means new controls and new compliance personnel.

It's a massive change management project. And it's fighting against the transition to the cloud, the exciting new mobile app, the new branch that's slated to be opened, and every other new business initiative.

Community banks and credit unions suffer these challenges to a degree that bigger banks don't. Large, multiline banks have enough projects - and the upside from the projects is great enough - that they can hire permanent, dedicated technology teams that implement project after project. It's a durable and ever-widening advantage over smaller competitors.

Perhaps the right strategy for a small community bank isn't to try to compete - it's to disadvantage the competition.

Gov't operated competition: boogeymen, discounts, and taxpayer dollars

Small community banks and credit unions make up for in political clout what they lack in transaction volume.

Community banks are celebrated. They make financing available to local businesses. They're the reason that farmers can afford seeds and families can afford homes. They're portrayed as integral to the American dream.

By contrast, almost no one has anything nice to say about big banks. They're regularly hauled before congress and blamed for every woe - inflation, housing shortages, climate change, you name it.

It's a perfect setup for a boogeyman. From the Wall Street Journal in 2019:

“There’s just a fear that the big banks really don’t have a need for the smaller banks and would rather just control all components of banking in the country,” said Kathy Strasser, chief operating officer at River Valley Bank, a $1.4 billion institution in Wisconsin.

It's a well-oiled playbook. Create a boogeyman then ask for salvation. The Clearing House saw exactly what was happening and responded accordingly.

The RTP "no volume discounts, no minimums" guarantees level the playing field for smaller financial institutions. The Clearing House partnered with technology providers Jack Henry, FIS, and Fiserv to cover the onboarding costs for minority-owned depository institutions to connect to the network. The company even overrepresented small financial institutions with four additional seats to the RTP Business Committee earmarked for community banks and credit unions.

But the effort appear to be to little avail. In 2019, the Fed announced its intent to move forward with its own government-funded competing network - FedNow. RTP adoption stagnated among community banks and credit.

Just two months ago the Fed announced a mid-2023 production rollout date for FedNow. From the Wall Street Journal on the announcement:

“A trusted and reliable government-run service that can enhance adoption of real-time payments is something credit unions are excited about,” said Greg Mesack, senior vice president at the National Association of Federally-Insured Credit Unions, which represents about 1,000 credit unions.

No sh!t. The Fed only has a mandate to cover costs not to generate a profit. Despite best efforts, it's ultimately a political creation that will be forced to cater to the long tail of community banks and credit unions at the expense of the relatively few large financial institutions that actually represent many more end users.

To add insult to injury, the Fed hasn't even planned to enable interoperability with RTP. It's an entirely separate and distinct payment service - government (read: taxpayer) subsidized - to compete with an already well-functioning and rapidly growing private sector solution.

With RTP already scaling but not yet ubiquitous, the outcome seems preordained - two competing payment networks, neither of which achieves ubiquitous scale, and every participant saddled with unnecessarily high costs.

But perhaps not.

Planes, Trains, and Automobiles

Allow me, by way of analogy, to explore a system of competing networks we already have live today - transportation.

Almost every town and city in the country has roads. Some, albeit fewer, have train stations. Even fewer have airports.

In one sense, government-funded highways compete with private-sector Amtrak and airlines. I can choose to drive to almost any location domestically, but I routinely take the train or fly instead. Often driving would be cheaper, but I value my time and the comfort of alternative modes of transportation. The government subsidizes a base transportation option (roads) and the private sector provides alternatives (planes, trains), often at greater cost to the traveler.

Domestic shipping follows a similar pattern. Government-operated USPS competes with private UPS and FedEx. The latter sells bells and whistles that USPS doesn't offer as part of their base service.

Interoperability is can be left to specialist network users or to the private network operators when it makes economic sense. Private train depots transfer containers from trains to trucks. FedEx Ground Economy (previously FedEx SmartPost) uses USPS for last-mile delivery.

A similar dynamic in real-time payments would unlock cheap basic service and more expensive bells and whistles.

RTP + FedNow = the best of all worlds

RTP is well positioned as the purveyor of bells and whistles. The Clearing House recently added a tokenization feature to the network - the same technology that is increasingly used to make your credit card transactions more secure. Rather than send the actual bank account number across the network, a jumbled ("tokenized") representation of the account number is shared instead. The Clearing House maintains a translation service so that only authorized participants can translate back from jumbled representation to real account numbers. If any fraudsters pilfer messages between sender and receiver, the information they collect is useless.

RTP also rolled out a document exchange so that invoices and other paper information can be included alongside the payment without resorting to email or yet another system.

These are nice-to-haves, not need-to-haves. The payment rail that instantly transfers value is the only essential component.

It can be delivered by FedNow.

It's absurd to think that the two networks need to talk to each other. Yes, it'd be convenient. But it'd also be convenient if the Visa and Mastercard networks interoperated. They don't. It's not a showstopper.

Interoperability can be solved by third-party tech vendors who float on top of both networks and make them seem like one. Perhaps information like account verification is exchanged on RTP and the actual payment is transferred on FedNow. With the right tech solution, the sender and receiver don't have to care about the details.

The combination of the two - RTP and FedNow - may be better than either alone.

The future of real-time payments

Did the Fed misstep? Almost certainly.

It derailed an already live, functioning, and rapidly growing private sector solution. It did it at the worst possible time - once over $1 billion had been poured into getting the network underway but before the network reached scale. The Fed meaningfully delayed the general availability of real-time payments.

But that delay is likely to be temporary. I expect we'll end up better off with two competing solutions rather than one standalone. FedNow will build slowly - at government speed - but nonetheless steadily raise the standard for the basic service. RTP will innovate faster, continuing to add new valuable services that users are happy to pay up for.

There's even a third dark horse candidate. Bitcoin.

Squint and you'll see it. You have to look past the cryptocurrency itself to the underlying network. It's highly interoperable, open-source, and easy to build on. There's a robust and ever-growing developer community endlessly building new and better solutions on top of it. It starts to look a lot like the early days of the internet, but one that moves money rather than data.

Caitlin Long, CEO & Founder of Custodia, put it best:

I don't expect that to happen soon. TCP/IP dates to 1983 yet banks didn't switch over for almost 20 years. But it'd be foolish to discount an emerging network on a trajectory like Bitcoin's.

Cocktail Talk

Is MoneyLion the 'Columbia House' of Predatory Loans? The CFPB's charges against MoneyLion are about as damning as any I've ever read. It's an indictment, not of the program itself, but of a failure to disclose appropriate information to users or make it easy to cancel. Especially when some of your members are active military members, that's a recipe for bad press and worse outcomes. (Fintech Business Weekly)

Societal Shift to Financial Repression: High Inflation, Higher Growth. I generally stay away from macroeconomic forecasting, but this caught my attention. Russell Napier - historian, money manager, and author - argues that we should expect increased government intervention in the economy, 6% inflation, and 8% nominal GDP growth. Essentially a money transfer from the old to the young as government reduces its debt obligations through financial repression. My knowledge of history isn't good enough to form a strong opinion, but the argument's nonetheless compelling. (The Market)

David McCullough Passes Away at 89. David McCullough, a titan of American history literature, passed away in August at age 89. His repertoire was extraordinary, no subject too small nor too large that an intimate story couldn't be told. I remember first reading 1776 for fun and then - to my surprise - having it assigned for AP US History. The Great Bridge chronicles the building of the Brooklyn Bridge. His presidential biographies - of Adams, Roosevelt, Truman, and Roosevelt - are second to none. A life well lived, the world is a little darker with his passing. (The Washington Post)

Your Weekly Cocktail

It settles the stomach after a long night with friends.

Rumpernickel

1.5oz Bully Boy Boston Rum

0.75oz Dolin Sweet Vermouth

0.50oz Averna

7 dashes Angostura Bitters

Pour everything into a mixing glass. Add ice until it comes up over the top of the liquid. Stir for 20 seconds (~50 stirs) until the outside of the glass is frosted. Strain into rocks glass and enjoy!

At my favorite bar in the world, Beverage Director Sother Teague organizes his menu by intensity, by alcohol forwardness. Having worked my way through more of the menu than is advisable in a single evening, I asked Sother if he wouldn't mind recommending a drink past the end of the list. The Pumpernickel was the next stop, an even spicer play on the Manhattan. But with the weather just teasing at fall, it's a bit much. The Rumpernickel sweetens it with a spiced Boston rum and brings a minty coolness to the forefront with Averna. It's a pitstop on the way to the last drink of the night, just in time for winter.

Cheers,

Jared

I'm not involved in the company beyond a de minimis equity holding bought in the public market, but I can't help but celebrate the extraordinary accomplishment as a proud brother.

A bit of a hand wave estimate by me. It's 61% of all US demand deposit accounts. Many individuals have multiple accounts so I've probably overestimated actual population access.